Total

Legal Accounting 3

SECTION

1.3.2.4 - BILL-OF-COSTS

USAGE: To enter File-bills. These are amounts invoiced to

the Client for services rendered and Disbursements paid on behalf of the

Client.

DISCUSSION: File-bills are used to associate a value you wish

to your Client to pay to you. A Client does not actually owe you money until a File-bill

is created. T.L.A. is an open-item system so the date of the transaction

is relevant.

When you start the BILL-OF-COSTS program,

T.L.A. initially asks you for a Client code. If you cannot remember the file

number, press <F9> to initiate a search. T.L.A. will check that the code does not refer

to a file that is closed.

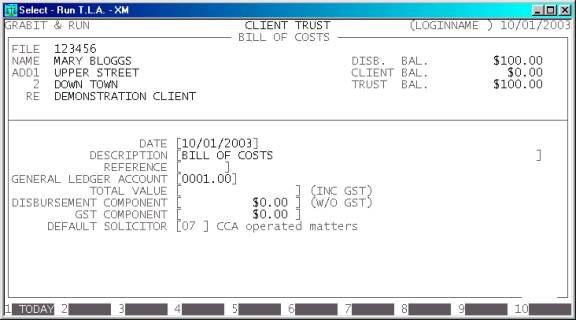

Typically, the screen will now look like this:

The file will be displayed with its corresponding

Name, Address and Matter Re. Also the current Disbursement, Client and Trust

balances are displayed on the left of the screen.

Next you must enter the details of the transaction.

There are several fields to enter:

Name Comments

DATE This field

defaults to today’s date (as per the date at the top right-hand-corner of your

screen). You may change it to any valid date within the calendar (as defined in

SECTION 7.1.6.) This is the date you wish to bill

the amount. Aging of the account will start from this date. You may return the

date to today’s date by pressing <F1>.

DESCRIPTION Here you enter the details of the transaction. It

defaults to BILL OF COSTS, but you can change it to any 50 character

description.

REFERENCE This field will default to

the last reference number you entered, plus one. Depending on your settings in SYSTEM

DEFAULTS (see SECTION 7.1.2) you may be able

to change it to a different, non-zero value. The largest value available is 999999. If you are using the

BILL-BOOK option, the reference number will default to zero and you must enter

a number associated with the current File.

GENERAL LEDGER ACCOUNT Here you

must enter the General Ledger account you wish T.L.A. to post the transaction

value to. It must be a Revenue or an Asset account.

TOTAL VALUE This is the total value you intend to charge the Client, including

GST.

DISBURSMENT COMPONENT The Bill might contain a

component of Disbursements (normally entered previously). If so, you should

enter the value here. This value will be removed from the Disbursement balance

for this File. The value entered here must be ex-GST.

GST COMPONENT Here you enter the value of

GST on this Bill. If you press <F1>, T.L.A. will automatically calculate the GST

assuming that the whole bill is GST-able. You may enter any value you wish into

this field as long as a) the sign of the value is the same as the TOTAL

VALUE field and

b) the DISBURSMENT COMPONENT plus the GST COMPONENT do not together exceed the TOTAL

VALUE.

DEFAULT SOLICITOR This field defaults to the

Solicitor code associated with this File. If you choose not to dissect the

bill, the full value will be posted to the total billings for this Solicitor.

At each point, you may cancel the Bill-Of-COSTS

by pressing <ESC>. However, it is possible to

return to a specific field by using <CsrUp> or <F8>.

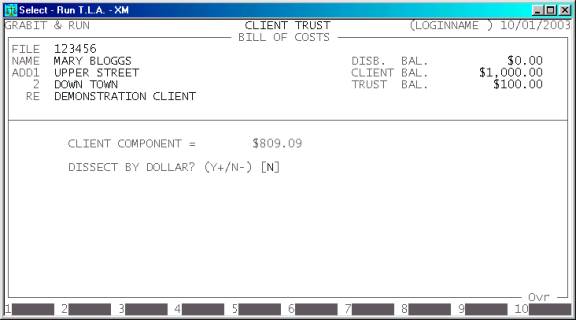

Next you may be asked if you wish to dissect the

bill amongst more than one Solicitor. This question will only be asked if there

is a Client component of the Bill (i.e. not all of it is taken up by

Disbursements and GST). Typically the screen will appear as follows. Note that

the value to dissect is only the Client Component.

Here

you have two choices. You may dissect the Client Component by dollar or by

percentage. Your choice depends on how the information is presented to you on

the Solicitor’s daysheet.

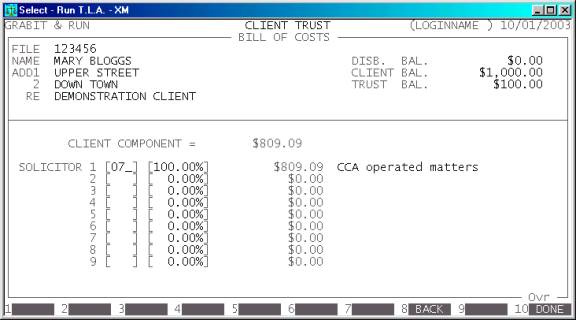

If

you choose to dissect by percentage, the screen will look like this:

Here you enter up to seven Solicitor codes with

their respective percentage. T.L.A. will display the value of the dissection.

Round-off errors are handled automatically. The total of the percentage must be

100%.

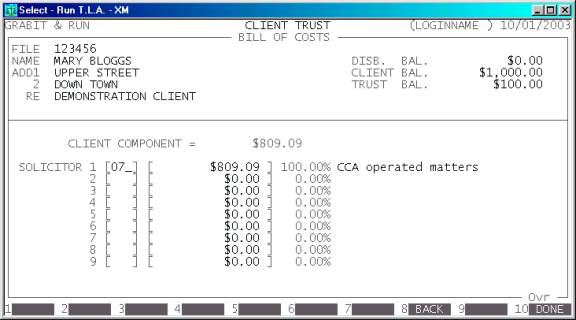

If

you choose to dissect by value, the screen will look like this:

Here you enter up to seven Solicitor codes with

their respective dissected values. T.L.A. will display the percentage of the

dissection. Round-off errors are handled automatically. The total value must

add-up to the Client Component and the sign of each dissection must be the same

as the Client Component.

In either case, you may return to the previous

screen by pressing <F8> or <PgUp>, or end the entry by pressing <F10> or <Enter> past the last field.

At the end of the BILL-OF-COST you will be asked to confirm the update. This is the

point of no return. Once you answer Y, T.L.A. will update all the relevant files. Up

to this point you can cancel or modify the details. After you have updated the BILL-OF-COST, you can only remove it by

entering a negative BILL-OF-COST i.e. the same entry but with a negative

value.

Finally you will be given the option to allocate the

Disbursement Component to unallocated Disbursements. This runs the same program

as the ALLOCATIONS function. The details of this function are discussed

in SECTION 1.3.2.6.2.

Files updated by the Bill-Of-Costs program:

Client/Trust

master-file: The File’s Client

balance is updated with the full value of the transaction. The Disbursement

Component is subtracted fro the Disbursement balance.

Client/Trust

transaction file: A transaction is

entered with the details of the transaction. This can consist of a File-Bill

transaction (with or without dissections) and a Disbursement to Client Journal

(if there is a Disbursement Component).

General

Ledger master-file: The Revenue/Asset

account is updated with the total value (including GST). The Client Ledger

account is updated with the value of the Client Component (ex-GST). The

Disbursement Ledger is updated with the value of the Disbursement Component.

Any GST component is posted to the GST account.

General

Ledger transaction file: A transaction

is entered with the details of the transaction for each General Ledger account

updated.

Audit

transaction-file: Each

transaction creates a line in the Audit file, which can then be printed in the AUDIT

TRAIL.