Total

Legal Accounting 3

SECTION

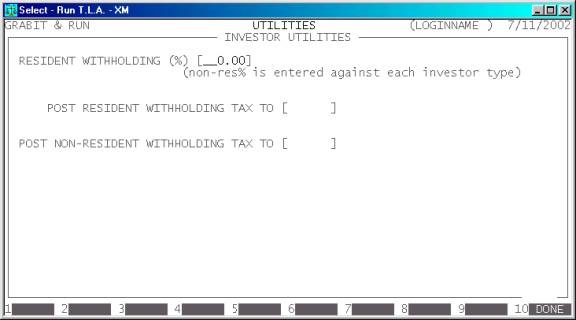

7.2.1.5.6 - INVESTOR TYPES UTILITIES

USAGE: This program allows you to

change General parameter that pertain to the Investor Types master-file.

DISCUSSION: When

you start the INVESTOR TYPES UTILITIES

program, the following screen will appear:

The fields available are:

RESIDENT WITHHOLDING % This field defines the percentage withholding tax

applicable to all investor types that correspond to residents. The non-resident

tax is entered against each applicable Investor Type.

POST RESIDENT WITHHOLDING

TAX TO When entering a MORTGAGE TRANSFER (see

SECTION 2.3.1) any withholding applicable to

residents, is posted to a special Trust File. Enter the Client/Trust account

number here.

POST NON-RESIDENT

WITHHOLDING TAX TO When entering a MORTGAGE

TRANSFER (see SECTION 2.3.1) any withholding

applicable to non-residents, is posted to a special Trust File. Enter the

Client/Trust account number here.

At each point when answering

the above questions, you can press <ESC> and the program will reset

and return you to the INVESTOR TYPES

MENU.

When you have finished entering your changes, press

<F10> and T.L.A. will save your changes after checking for any

inconsistencies and confirming your request. Your changes will be saved to disk,

over-writing any previously stored information.