Total

Legal Accounting 3

SECTION 2 - MORTGAGES MENU

The Mortgage Register has been designed to maintain

the static details of a Mortgage attached to a Client/Trust file. There can be only

one Mortgage File for any particular Client/Trust file. Also, it is usual to only

use that Client/Trust file for the purposes of the Mortgagor. Any kind of

transactions can be entered into the Trust card but only Trust transactions are

displayed or printed when making enquiries in the Mortgage sub-system. (I.e.

General transactions are ignored.)

Apart from the name of the Mortgagee, the card also

allows entry of up to 15 contributors. These must also have Client/Trust files.

This information is used for automatic dissection of TRUST TRANSFERS

from the Mortgagor's file. (See SECTION 2.3.1.)

The normal sequence of use for a Mortgagors file is

as follows:

1)

Receive

monies from the Mortgagee's file (TRUST RECEIPT).

2)

Pay

this to the Mortgagor. (TRUST CHEQUE).

3)

Receive

interest. (TRUST RECEIPT).

4)

Take

out charges. (FILE BILLS, TRUST TAKE-BACK, etc.)

5)

Transfer

the net interest payment to the Mortgagee's file (TRUST TRANSFER JOURNAL)

and the dissect this amount to the Contributors if necessary (also TRUST

TRANSFER JOURNALS). It is possible to do all of the TRUST TRANSFER

JOURNALS (in this part) via the special transaction type: MORTGAGE

TRANSFER JOURNAL.

6)

When

the loan is repaid, the balance is received into the Mortgagor's file (TRUST

RECEIPT) and the transferred to the Mortgagee (TRUST TRANSFER).

Various specific reports are available to facilitate

recovery of interest payments.

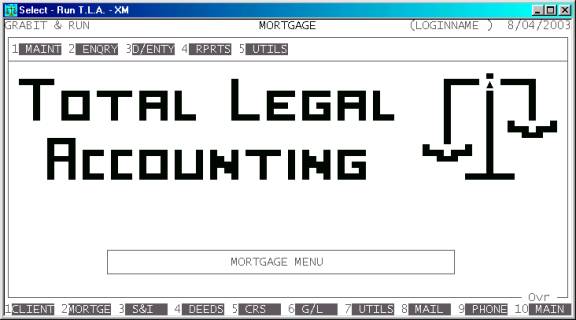

The MORTGAGE

MENU is accessed as item 2 or <F2> from the MAIN

MENU. On selecting this menu the following menu will be displayed:

To return to the MAIN MENU, press <ESC>.

Fields

available on the MORTGAGE MASTER file.

Name Comments

MORTGAGOR'S FILE This is the file number of the Mortgagor's

Client/Trust file. It is up to 6 characters long. The Client/Trust card must

exist and cannot be deleted until the Mortgage file is deleted.

MORTGAGEE'S FILE This is the file number of the Mortgagee's

Client/Trust file. It is up to 6 characters long. The file must exist. This is

an intermediate file, as interest payments are finally transferred to the

contributor files, see below. This file is usually belongs to the practice

itself.

CONTRIBUTORS There are 15 entries here.

Each has the code of the Client/Trust file of the Contributor and the value of

the contribution. Each file must exist and the contribution must be greater

than zero. The sum of contributions should equal the PRINCIPAL SUM (see below). It is possible to have no contributors

entered here. In this case, the Mortgagee is the only contributor and this

section is left blank. It is also possible to enter a commission rate here for

each contributor. This is any value from 0.001% to 99.999. It represents the

agreed commission to be taken off any interest payments as they are dissected

to the contributors. The MORTGAGE TRANSFER program can do this

automatically. (See SECTION 1.3.1.) It is usual to

enter a penalty commission rate also. This is normally higher than the normal commission

rate and can be chosen when a MORTGAGE TRANSFER is made.

PRINCIPAL This is the original amount lent (Principal Sum). It

is must not be zero and should be equal to the sum of the contributions.

DATE LENT This is the starting date of the mortgage. I.e. when

the Principal Sum was lent.

DATE REPAYABLE This is the date the principal sum is repayable. It

must not be less than the date lent.

CHANGES Here you may enter up to two lines of changes. There

is space for both the new sum lent and the date it happened. There is no

provision for keeping track of any new repayable date as this tends to stay

constant.

ACCEPTABLE RATE (%) &

AMOUNT This is normal (lower) percentage interest rate of

the loan and the value it represents.

HIGHER RATE (%) &

AMOUNT This is

the penalty (higher) interest rate of the loan and the value it represents.

RESTS This is a documentary entry describing the rests in

interest payments.

PERIOD This is a single letter representing the period of

interest payments. The options are: M for monthly payments, Q for quarterly payments, H for Half-yearly payments

and Y for yearly payments.

SECURITY ADD This contains the address of the Mortgagees property.

TITLE - VOLUME &

FOLIO There are four groups of entries here. Each has two

spaces for a Volume & Folio number, respectively. Each field is five

characters field wide. Thus you can document up to four Titles associated with

this Mortgage.

VALUATION This is estimated dollar value of the security.

ESTABLISHED BY This contains the name of the valuer.

REGN. NO This is a 10 character field containing details of

the Registration or Dealing number.

UNSEC. PARTICULARS If the mortgage is unsecured, the particulars must

be entered here.

MORTGAGE TYPE Here you enter which type of Mortgage this is. Eg.

First, Second, etc.

INSURANCE CO.NAME Here you enter the name of the insurance company

insuring the property or loan.

AMOUNT OF COVER Here you enter the value of the insurance cover.

DUE DATE This is the due date of the insurance policy.

POLICY NUMBER This is the number of the insurance policy.

DEED PACKET NO. Here you enter the Deed Packet Number associated with

this Mortgage.

Apart

from these fields, you can also use the function keys to access several

free-format fields.

NOTE (<F4>) This is a field that allows you to attach a comment to the account.

For instance, you might use this to store details of a dispute.

COLLAT (<F6>) This is a field that allows you to list any special collateral

information.