Total

Legal Accounting 3

SECTION

1.3.2.8 - CLIENT REFUNDS

USAGE: To refund monies incorrectly paid by your Client

to you.

DISCUSSION: General Cheques only affect the Disbursement

account. If you have overcharged a Client or if your Client has overpaid an

account, you could write a cheque from the General Cheques program but shifting

the monies back to reconcile the account requires a number of negative

transactions. These are difficult to enter and difficult to follow. If all you

wish to enter is a General Cheque that updates the Client balance, the current

function is far simpler.

When you start the CLIENT REFUNDS program,

T.L.A. initially asks:

ENTER

CHEQUE TOTAL [__________$0.00 ]

Here you enter the value of the Cheque to be drawn.

The value entered must not be zero, however, it may be negative if you are

reversing a previous entry.

Next you are asked which General Bank Account the

monies will be deposited into:

POST TO

BANK ACCOUNT [ ]

Enter the last four digits of the bank account and

press <Enter> or <F10>. If you have only one account, set this GENERAL

LEDGER CONTROL ACCOUNTS (see SECTION 6.5.2) to

save time. If you have multiple General accounts, you may press <F9> to initiate a search.

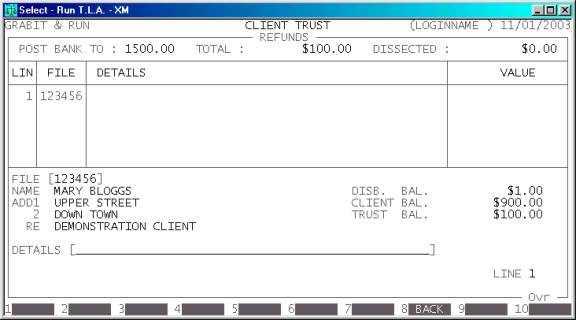

Typically, the screen will now look like this:

The top of the screen displays the General Bank account

you are posting to, the total value of the refund and the value dissected so

far. At this point the total dissected is zero. T.L.A. will not allow you to

update the Cheque until the Dissected value is exactly equal to the Total

value.

Enter a Client code and press <Enter>. Alternatively, press <F9> to initiate a search. The

Client file you enter must refer to an active (not completed) file. It is

possible to enter a transaction that makes the Client balance negative (in

credit).

The screen will now typically look like this:

T.L.A. will display the Name of the File, the

Address and Matter Re. Also the current Disbursement, Client and Trust balances

are displayed on the left of the screen. These balances are updated when monies

are applied to show you what the account will be when the current transaction

is updated. This can be a useful check. You should look at these balances

before updating the line.

There are several fields to enter:

Name Comments

DETAILS Here you enter the details of the transaction, eg. COURIERS. If you are entering multiple lines, you can repeat

the previous line by pressing <F1>. This repeat function will

remain live until you exit to the menu program.

VALUE This is the value of the line. It might be the full

value of the Cheque or the portion to be dissected to the current file. You may

not enter a value that would cause the Cheque to be over dissected. You may

press <F9> to open the on-screen

calculator. The result of the calculation will be automatically inserted into

this field.

At each point, you may cancel the REFUND

by pressing <ESC>. However, it is possible to

return to a specific field by using <CsrUp> or <F8>.

If you have entered at least one line, you may press

<F5> (at the FILE field) to enter the REVIEW

function. This function allows you to view your entries, and if necessary

change or delete a line. To move between lines use <CsrUp>, <CsrDn>, <PageUp>, <PageDn>, <Home> and <End>. If there is a particularly

large number of lines, you can also use <F9> to go to a specific line

number. To modify a line, make sure it is displayed in full in the bottom

window and press <F3>. You can then re-enter any

of the details. To leave the REVIEW function, press <ESC> or <F10>, once.

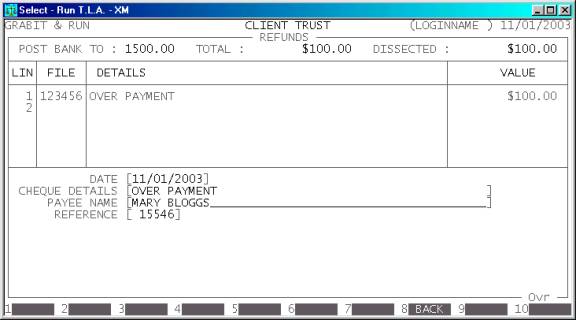

To end your lines, press <F10>. You will be asked to confirm that you have

finished entering lines and then you will be asked certain trailer information.

In some states, certain fields may be turned off or be inaccessible. A Complete

list follows:

DATE This field

defaults to today’s date (as per the date at the top right-hand-corner of your

screen. You may change it to any valid date within the calendar (as defined in SECTION 7.1.6.) You may also return the date to today’s

date by pressing <F1>. Note that this date has an effect on clearance dates. You should

enter the date you received the monies.

CHEQUE DETAILS This field

will be printed on the remittance portion of the Cheque. The default is the

description of the first line but you can change it to any 50 character string

that generally defines the reason for the Cheque.

PAYEE NAME This field may be left blank

but it is generally filled in if the Cheque is being made out to someone other

that the name on the file.

REFERENCE This field will default to

the last reference number you entered, plus one. Depending on your settings in SYSTEM

DEFAULTS (see SECTION 7.1.2) you may be able

to change it to a different, non-zero value. The largest value available is 999999.

The screen will typically look like this:

At every point you can press <CsrUp> or <F8> to return to the previous

field.

At the end of the REFUND you will be asked to confirm the update. This is the point

of no return. Once you answer Y, T.L.A. will update all the relevant files. Up to this point you can

cancel or modify the details. After you have updated the REFUND, you can only remove it by entering a negative REFUND i.e. the same entry but with a negative value.

If you have enabled the printing of cheques, T.L.A.

will offer to print a cheque now. This is your only opportunity to print the

cheque. Afterwards, you will be returned to the Cheque Value entry screen where

you may either enter another REFUND

or press <ESC> to return to the TRUST DATA ENTRY MENU.

Files updated by the Client Refund program:

Client/Trust

master-file: The individual

dissections are added to the Client balance.

Client/Trust

transaction file: Each Cheque generates a

transaction. This can be viewed in CLIENT/TRUST

ENQUIRIES and is used to create reports, such as CLIENT STATEMENTS.

Reconciliation

File: Each Cheque is posted to the

Reconciliation File to be later compared with the Bank statement.

General

Ledger master-file: The General Bank

account is updated with the value of the Cheque.

General

Ledger transaction-file: A

transaction is posted for the total value of the Cheque.

Audit

transaction-file: Each

dissection creates a line in the Audit file, which can then be printed in the AUDIT

TRAIL.