Total

Legal Accounting 3

SECTION

1.3.2.5.1 - GOVERNMENT CHARGES - ONE CLIENT

USAGE: To enter apply the government charges (eg GDT).

This program allows you to choose a single Client and apply the value.

DISCUSSION: Each General or Trust Receipt and Cheque entered

can potentially carry a Government charge. T.L.A. can compute this charge and

create a special Disbursement transaction applying the charge to the

Disbursement balance. The charge rates are setup in GOVERNMENT CHARGES

(see SECTION 7.2.1.7). The current uncharged value

can be displayed in CLIENT/TRUST ENQUIRIES. The calculation is reset

when a transaction (from this program) is generated. Thus T.L.A. maintains a

total of uncharged government charges.

When you start the GOVERNMENT CHARGES

program, T.L.A. initially asks you for a Client code. If you cannot remember

the file number, press <F9> to initiate a search. T.L.A. will check that the

code does not refer to a file that is closed.

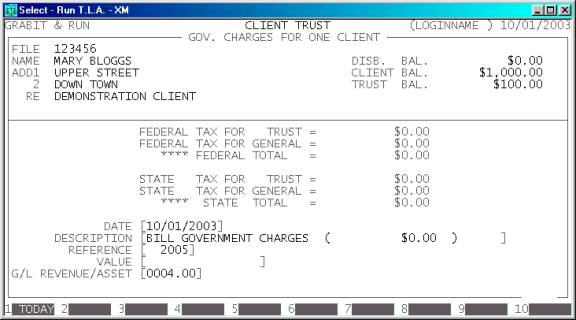

Typically, the screen will now look like this:

The file will be displayed with its corresponding

Name, Address and Matter Re. Also the current Disbursement, Client and Trust

balances are displayed on the left of the screen. The current computed charges

are shown. This display is similar to the one in CLIENT/TRUST ENQUIRIES.

Next you must enter the details of the transaction.

There are several fields to enter:

Name Comments

DATE This field

defaults to today’s date (as per the date at the top right-hand-corner of your screen).

You may change it to any valid date within the calendar (as defined in SECTION 7.1.6.).

DESCRIPTION Here you enter the details of the transaction. The

description defaults to BILL GOVERNMENT CHARGES and the calculated value

in brackets.

REFERENCE This field will default to

the last reference number you entered, plus one. Depending on your settings in SYSTEM

DEFAULTS (see SECTION 7.1.2) you may be able

to change it to a different, non-zero value. The largest value available is 999999.

VALUE This is the actual value of the Disbursement. This

amount can be negative if you are reversing a previously incorrect entry.

Normally you would enter the value as computed by the computer. However, if you

are about to close the file and you may wish to enter a larger value to cover

expected transactions. Also, you may wish to write-off the charges (up to date)

in this case you can leave the value as zero. This will insert a transaction

(an start the calculations from that date) without actually creating a value.

G/L REVENUE/ASSET Here you

must enter the General Ledger account you wish T.L.A. to post the VALUE to. It must be a Revenue or an Asset account.

At each point, you may cancel the GOVERNMENT

CHARGES by pressing <ESC>. However, it is possible to

return to a specific field by using <CsrUp> or <F8>.

At the end of the GOVERNMENT CHARGES you will

be asked to confirm the update. This is the point of no return. Once you answer

Y,

T.L.A. will update all the relevant files. Up to this point you can cancel or

modify the details. After you have updated the GOVERNMENT CHARGES, you

can only remove it by entering a negative GOVERNMENT CHARGES i.e. the same entry but with a negative

value. Note that this will not reverse the reset effect.

Files updated by the Disbursement program:

Client/Trust

master-file: The Client’s

Disbursement balance is updated with the value of the transaction.

Client/Trust

transaction file: A transaction is

entered with the details of the transaction.

General

Ledger master-file: The Asset/Revenue

account and the Disbursement Ledger will be updated with the value of the

transaction.

General

Ledger transaction file: A

transaction is entered with the details of the transaction for each General

Ledger account updated.

Audit

transaction-file: Each

transaction creates a line in the Audit file, which can then be printed in the AUDIT

TRAIL.