Total

Legal Accounting 3

SECTION

1.3.2.3 - DISBURSEMENTS

USAGE: To enter Client Disbursements, i.e. payments made

on behalf of a Client, to be billed later.

DISCUSSION: As you proceed with a file, there will be charges

that you pay on behalf of your Client (other than those made via Trust Cheques

(see SECTION 1.3.1.2). These might include

courier fees, photocopying charges and other incidental costs (other than

time). This program allows you to assign these costs to the Client’s file. You

may then bill then along with any time or other fees when the file is finally

costed. Often the fees entered correspond to one of your Creditors. T.L.A.

allows you to enter the Creditor code and associated information and it then

automatically posts the Purchase to the Creditor’s file and General Ledger.

This saves having to enter two separate parts of the system. It also links the

transactions (Client and Creditor) so that they can be reported on together, if

required.

When you start the DISBURSEMENTS program,

T.L.A. initially asks you for a Client code. If you cannot remember the file

number, press <F9> to initiate a search. T.L.A. will check that the code does not refer

to a file that is closed.

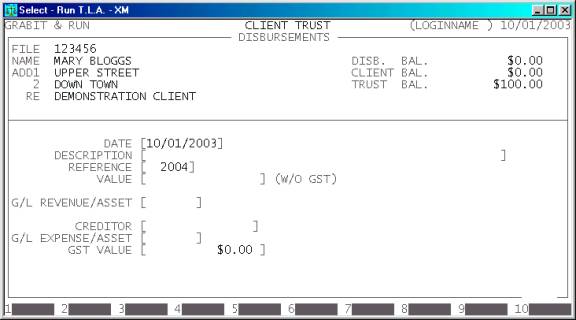

Typically, the screen will now look like this:

The file will be displayed with its corresponding Name,

Address and Matter Re. Also the current Disbursement, Client and Trust balances

are displayed on the left of the screen.

Next you must enter the details of the transaction.

There are several fields to enter:

Name Comments

DATE This field

defaults to today’s date (as per the date at the top right-hand-corner of your

screen). You may change it to any valid date within the calendar (as defined in

SECTION 7.1.6.) This is the date the transaction

was received by you.

DESCRIPTION Here you enter the details of the transaction, eg. COURIER FEES.

REFERENCE This field will default to

the last reference number you entered, plus one. Depending on your settings in SYSTEM

DEFAULTS (see SECTION 7.1.2) you may be able

to change it to a different, non-zero value. The largest value available is 999999.

VALUE This is the value of the Disbursement. This amount

can be negative if you are reversing a previously incorrect entry. It

represents the full value of the amount that will be recovered from the Client.

The amount should be entered ex-GST. This is because GST will be charged

when the File-bill is entered.

G/L REVENUE/ASSET Here you

must enter the General Ledger account you wish T.L.A. to post the VALUE to. It must be a Revenue or an Asset account.

CREDITOR If you wish to post the

transaction to the Creditor sub-system, you should enter a Creditor code here.

A typically scenario would be: you receive a bill from a courier company for

transport of documents; you would post the value of the bill (less GST) to the

Client’s file and you would also wish to create a Purchase in the Creditor’s

file (assuming the courier is one of your creditors. You may leave this field

blank, if there is no Creditor associated with the transaction. If you do not

remember the Creditor’s code, press <F9> to initiate a search.

G/L EXPENSE/ASSET Here you must enter the

General Ledger account you wish T.L.A. to post the Purchase value (less GST)

to. It must be an Expense or a Liability account. This field is skipped if

there is no Creditor entered.

GST VALUE This is the amount of GST

billed to you by the Creditor. This field is skipped if there is no Creditor

entered.

At each point, you may cancel the DISBURSEMENT

by pressing <ESC>. However, it is possible to

return to a specific field by using <CsrUp> or <F8>.

At the end of the DISBURSEMENT you will be asked to confirm the update. This is the

point of no return. Once you answer Y, T.L.A. will update all the relevant files. Up

to this point you can cancel or modify the details. After you have updated the DISBURSEMENT, you can only remove it by

entering a negative DISBURSEMENT i.e. the same entry but with a negative

value.

Files updated by the Disbursement program:

Client/Trust

master-file: The Client’s

Disbursement balance is updated with the value (ex-GST) of the transaction.

Client/Trust

transaction file: A transaction is

entered with the details of the transaction.

Creditor

master-file: If you have entered a

Creditor code, the balance of the Creditor will be updated by the total

transaction value (inc-GST).

Creditor

transaction-file: A Purchase

transaction will be created with the details of the Disbursement. The

their-reference number field will contain the Client’s file number.

General

Ledger master-file: Two, four or five

accounts are updated by this transaction type. Initially, the asset/revenue

account will be posted to and the corresponding entry will be made to then

Disbursement Ledger account. Then, if a Creditor code was entered, T.L.A. will

update the Trade Creditor account with the full value of the transaction, the

relevant expense/liability account with the ex-GST value and the GST account

with the value of the GST (if the GST value is not zero).

General

Ledger transaction file: A

transaction is entered with the details of the transaction for each General

Ledger account updated.

Audit

transaction-file: Each

transaction creates a line in the Audit file, which can then be printed in the AUDIT

TRAIL.