HiFinance

5

SECTION

1.3.4.5 - DEBTOR RECEIPTS - SEND TO EFT

USAGE: This function is only available if you have the

EFT option enabled. The purpose of this function is to extract a list of all

invoices that can be paid by direct debit. This of course will only work if you

have the relationship with your clients where you are able to directly extract

payment from their accounts. The function allows you tag any appropriate

transaction, and will produce a report and a file suitable for import to the

bank EFT programs.

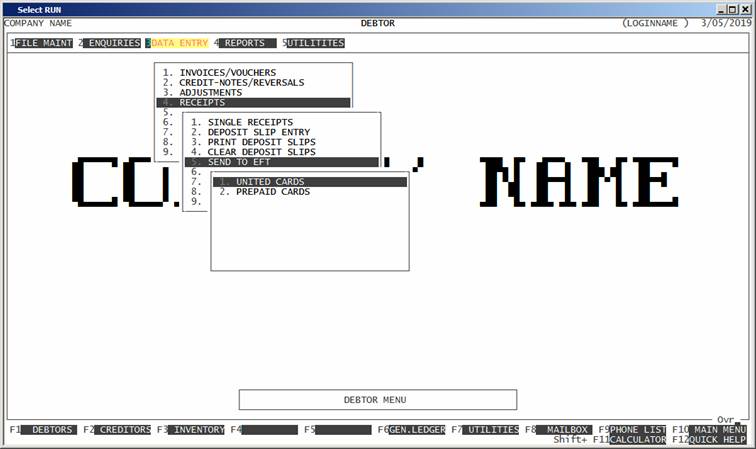

If you are using the Card Option, this menu option

will present you with a menu, as follows.

Here you can choose to either use the standard EFT

extract, as discussed below, or the PREPAID

option (see SECTION

1.3.4.5U.2).

DISCUSSION: Before you can extract a report, you must tag at

least one Debtor as a credit type 4 (see SECTION 1 - DEBTORS).

You will also need to enter the bank details. In certain installations, you are

also asked certain masking information, specific to that installation, which

will mask the extraction to certain limits.

As this program updates the bank, if you are running

multi-banking, you will first have to choose which bank you wish to attach the

payments to. It is not possible to choose more than one bank.

For certain installations, there is the option to

certain ranges:

INCLUDE “TERMFEE” This

option includes Debtors in the group TERMFEE. If you wish to exclude

these Debtors, enter N.

INCLUDE NON “TERMFEE” This

option includes Debtors with a group other than TERMFEE. You must enter Y to either this or the

previous question. You can answer Y to both.

SITE RANGE This option allows you to enter

a range of Sites. By default, the lower limit is 000 and the upper limit is 999. If you leave these fields

as the default, no checks will be made. If you enter a value other than the

default, HiFinance will exclude any transaction that has no SITE= value in the description or

SITE=XXX

where XXX is less than the lower limit or higher than the upper limit. This is

usually used where the operator has changed and you need to limit the payments

to one Site. In this case, make the lower and upper limits the site number.

When the SEND TO EFT program starts, it will scan

the Debtor transaction file. The program will extract any debit transaction

that is:

a) attached to an EFT Debtor,

b) can be paid on the current

day, eg the correct day of the week or month,

c) completely un allocated,

d) has not been previously

tagged as REJECTED,

e) has been around for long

enough to pass the AFTER WAITING DAYS trigger.

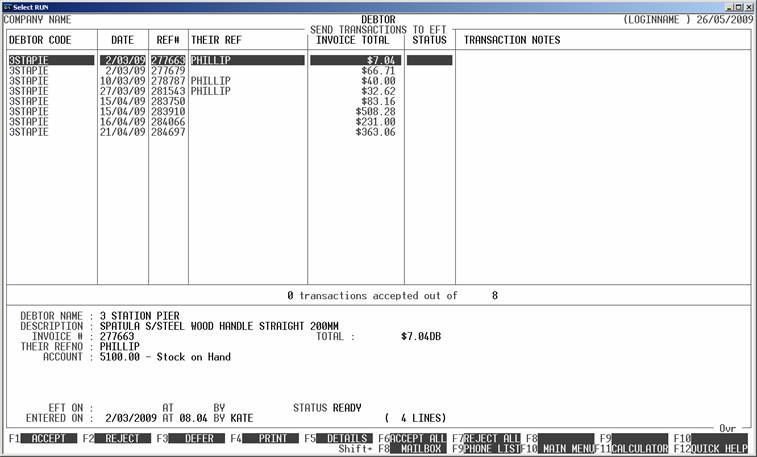

When the scan has finished, you will be presented

with the following screen:

The following function keys are available:

<F1> This will tag the highlighted line as ACCEPTED. This will tell the program that the current

invoice may be paid via the bank interface. Most transactions will be tagged

this way.

<F2> This will tag the highlighted line as REJECTED. This will tell the program that the current

invoice should never be paid via the direct banking facility. The

transaction will be tagged as such and will never come up in this report again.

You will then have to manually deal with this transaction. You would use this

facility when the customer tells you not to extract a specific invoice from

their account because the might, for instance, be paying it by cheque. Also, if

an invoice is in dispute, you should tag it here, so that you cannot

accidentally extract the money automatically.

<F3> This will tag the highlighted line as DEFERRED. This will tell the program that the current

invoice should put back into the transaction file because you don’t wish to

extract the money today. The transaction will come back as a “payable” item

when you run the report next time (assuming that the date criteria match),

<F4> This will cause the program to print a list of the

list, as it currently stands. You can use this as an intermediate list, to tick

off your choices. You should print the report at least once. If you try to

update the file, and you have made changes since the last report print, you

will be reminded to print the report again. The report is suitable for manual

input to an on-line banking data entry screen. It can be thus also be used when

your on-line system fails to import the transfer file, see below.

<F5> This will display the details of the invoice in the

lower portion of the screen. The format of this display is similar to that in

the DEBTOR ENQUIRY function (see SECTION 1.1).

You can also print the details, if this is helpful.

<F6> This will set

all transactions to the ACCEPTED status.

<F7> This will set all transactions to the DEFERRED status.

<F10> This option will only become live when you have set the

status to every line to something other than blank. When you press <F10> you will be asked print the report, unless you have

just printed it. You must answer YES or NO to this question. After the report has been printed you will be asked to

confirm the update. There is no way back if you answer YES so it is important to make sure that all is completely correct before

you proceed.

The

program will export a file called XXX-ODP.ABA, where XXX is your company code as defined in SYSTEM PARAMETERS. Case is

not important. This file is in the main data directory, eg h:\hf5data\comp1\hor-odp.aba. This file can then be

directly imported to the bank EFT programs. You will still need to accept the

transactions within this program.

Files updated by the Send to

EFT program:

Debtor

transaction-file: Each transaction

will be tagged with either ACCEPTED, REJECTED or DEFFERED, and time stamped so that

the DEBTOR TRANSACTION ENQUIRY program can display the status. The

transactions are not tagged as paid. This is a separate function,

which you do, when the bank tells you that the moneys have been transferred

into your account.