HiFinance

5

SECTION

1.3.4.1 - DEBTOR SINGLE RECEIPTS

USAGE: To apply credits to Debtors. This function assumes

you are entering single receipts, eg single cheques, etc. The program asks for

the receipt details and then the allocation details before applying the

transaction to the Debtor.

DISCUSSION: When you start the DEBTOR

RECEIPTS program, the computer will initially ask for a Debtor code.

Insert the code and press <Enter>.

To return to the DEBTOR DATA ENTRY MENU, press <ESC>.

To search for a Debtor, press <F9>. For further details on searches, see SECTION 1.2.

Having chosen a Debtor, you may be asked which bank

you wish to post to. This question will only appear if you have enabled multi-banks.

Enter the account number of the bank you wish to post to or press <F9> to initiate a search.

BANK ACCOUNT [0000]

If are running with a single bank, all bank postings

will automatically be made to the default bank.

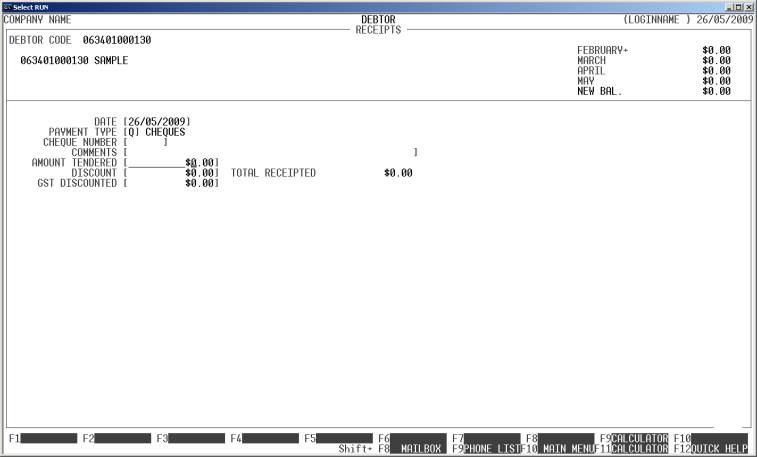

The screen will display the name and address and

recent balances, in full at the top of the screen. The screen will appear as

follows:

The fields available are:

DATE This is date you wish to make the receipt apply. The

date does not have to be in the current period, but if you backdate a

transaction, HiFinance will not let you choose a date in a closed period. To

close a period, use the CALENDAR

function. (See SECTION

7.1.6.). Generally, you should enter the date as per the date you are going

to deposit the monies, usually today’s date. If you press <F1>, HiFinance will insert today’s date into this

field. If you press <F2>, HiFinance will insert yesterday’s

date into this field.

PAYMENT TYPE This is a letter from A to Z. It refers to the type of payment made, eg C = Cash, Q = Cheque, etc. The payment

types are defined in BANK TRANSACTION

TYPES, (see SECTION

7.2.5). The default value for this field is determined by a field in

the SYSTEM DEFAULTS (see SECTION 7.1.2).

However, this, in turn can be overridden by the NORMALLY PAYS BY field in DEBTOR

MAINTENANCE (see SECTION 1).

REFERENCE NUMBER This can be any number from 1 to 99999999. It is a reference for your internal auditing. It

is labelled REFERENCE NUMBER for cash type transactions.

The prompt changes to CHEQUE NUMBER if you are entering a

Cheque. For entries that must have come from a reconciliation sheet, the prompt

reads STATEMENT PAGE.

COMMENTS This is an optional field. You might wish to add some details

regarding this receipt.

AMOUNT TENDERED This is the actual value of the payment received. If

the Debtor is paying the whole amount outstanding, you may press <F1> to insert the value. Note that this value must be

positive. If you press <F9>, you will initiate HiFinance’s calculator. When you press <ESC> from the calculator, the result will be inserted

into the AMOUNT

TENDERED field.

If the customer is paying the full amount, it is possible to press <F1> here and HiFinance will inset the full Debtor

Balance. This often saves time.

DISCOUNT If you have allowed the Debtor to take a discount, you may

enter the value here. This is also a convenient way of entering any small

amount the Debtor did not pay, eg 10 cents out of an Invoice for $1000. This is

simpler than separately entering a write off amount through DEBTOR ADJUSTMENTS. Like the AMOUNT TENDERED, this value must be positive.

TOTAL RECEIPTED This field is automatically inserted by HiFinance.

It is the sum of AMOUNT TENDERED and DISCOUNT.

GST DISCOUNTED If you have entered a discount, there might be a GST

component. If so, HiFinance needs to know that value so that it can post

correctly to the General Ledger. The value you enter represents the portion of

the discount that is GST, so it cannot be greater than the value of the

discount. An example might be:- an outstanding balance of $105; the Debtor pays

a cheque for $100 and you offer a discount of $5, which includes 50¢ of GST.

The entries would be 100, 5 and 0.5 for amount, discount and GST, respectively.

If you have chosen to print DEPOSIT SLIPS and you

are entering a Cheque type transaction, you will be asked the next three

fields.

BANK This is a 3 character field that allows you to

enter the initials of the bank on the cheque.

BRANCH This is a 15 character field that allows you to enter

the branch on the cheque.

DRAWER This is a 50 character field that allows you to enter

the drawer of the cheque. If you leave this field blank, HiFinance will insert

the Debtor’s name.

<ESC> To abort the whole transaction, press <ESC>. You will then be returned to the Debtor code

entry routine.

You will next be asked, RECEIPT DETAILS OK? If they

are, enter Y. If there are no outstanding debits, HiFinance will simply update

the Debtor. This is useful for entering pre-payments. If there is at least one

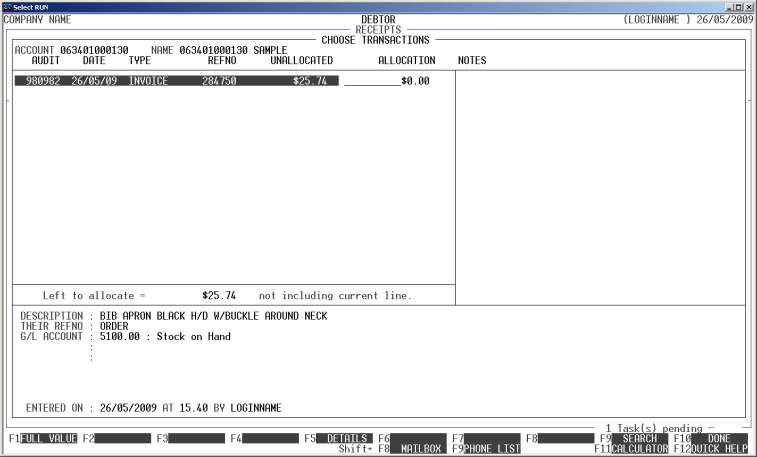

outstanding debit, the screen will change and ask for allocation information. A

screen will typically look as follows:

This is similar to the allocation screen in DEBTOR ALLOCATIONS (see SECTION 1.3.5.)

The main difference is that if you do not allocate the whole amount of the

Receipt, you will be required to enter a reason for the partial allocation. The

result of this is that HiFinance will force the Receipt to be completely

allocated. Any portion left over is accounted for by an adjustment transaction

that carries its own description. A legitimate reason could be OVER PAYMENT.

If you are allocating to a Debtor who has

sub-accounts, <F3> will be available for you

to mask the display to one sub-account at a time. This can be useful if there

are a lot of transactions, spanning several accounting periods and the Debtor

has made a payment that spans several sub-accounts. Instead of looking through

hundreds of transactions for the ones to allocate the payment against, you can

mask one sub-account at a time, and then allocate to a shorter list. Note that

that you cannot mask to the main Debtor itself. Once you have masked, you can

press <F3> again to mask to another

sub-account or press <F4> to clear the masking.

Although it is not necessary to clear masking before updating the allocations,

it is recommended that you do, for the purposes of checking your entries.

You should also notice that <F5> is available to display the full details of the

highlighted transaction. This functions very similarly to Transaction Enquiries

screen. This facility is included so that you can more easily identify a

specific transaction when there are several with similar values. You cannot

change the transaction itself.

If you have enabled single Creditor cheques, you

will next be asked if you wish to print a cheque. If you answer Y, a cheque will be printed. Cheques cannot be reprinted. If you are

paying a cheque to the SUNDRY Debtor, you will be asked

for the name and address. The name is compulsory. A warning will be displayed

if you leave the first line of the address blank. If you have entered a cheque

number of 999999, no cheque will be printed.

The cheque number is reserved for special entries that can be easily deleted

from the Bank Reconciliation file.

Files updated by the Debtor Receipts program:

Debtor

master-file: The Debtor’s balance will

be decreased by the TOTAL RECEIPTED.

Debtor

transaction-file: A receipt transaction

is created to match the total value of the TOTAL

RECEIPTED. It

also carries the value of any discount allowed. If the receipt has not been

fully allocated, an adjustment record is created for the balance.

General

Ledger master-file: The Trade Debtors,

Cash-at-Bank and Discounts Allowed accounts are updated. If there is a GST

component to the discount, the value is split between the Discount Allowed and

GST chargeable.

General

Ledger transaction-file: A

transaction is posted for each transaction line.

Bank

master-file: The Bank master-file is

updated to reflect the fact that there has been a change of balance and that

there is a bank deposit slip pending.

Bank

transaction-file: If you have

chosen to print Bank Deposit Slips, HiFinance will enter a transaction into

this file for later printing.