HiFinance

5

SECTION

1.3.1 - INVOICES

USAGE: To bill customers for sales of goods and services.

Invoices can be either entered here or converted from SALES ORDERS previously entered. (See SECTION 1.3.7.)

DISCUSSION: When you start the INVOICE program, the

computer will initially ask for a Debtor code. Insert the code and press <Enter>.

To return to the DEBTOR DATA ENTRY MENU, press <ESC>.

To search for a Debtor, press <F9>. For further details on searches, see SECTION 1.2.

Having chosen a Debtor, the screen will display the

name and address and recent balances, in full at the top of the screen. Also,

if you have attached a note to this Debtor, the note will appear superimposed

in the middle of the screen. You might also be warned that of a credit limit

imposed on the Debtor. Depending on your installation, other warnings may also

appear. If the Debtor has been tagged as DORMANT

or on STOP CREDIT, you will not be

able to proceed.

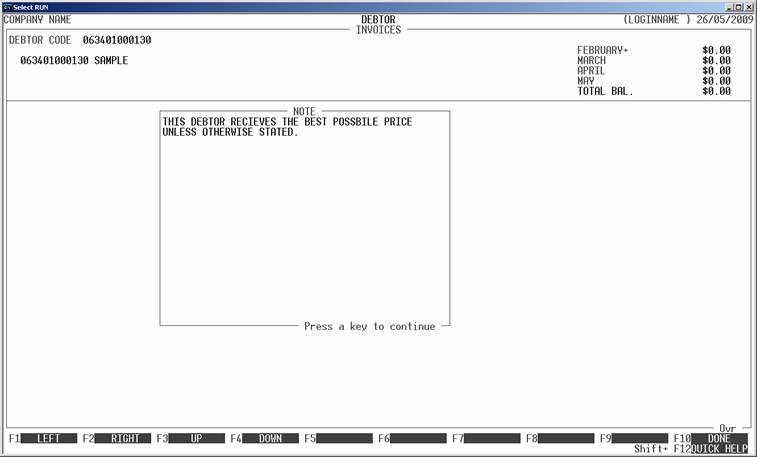

The screen will appear as follows:

Press <Enter> to clear the note and you

will then be asked a series of questions. These relate to the ribbon

information on the INVOICE and also

control such things as tax and discounts. The exact list of fields displayed

depends on how you have chosen the options in SYSTEM DEFAULTS. (See SECTION 7.1.2.) Fields that are not displayed take their

values from the defaults set on the Debtor’s master-file.

Note that if there are any active Sales Orders for

this Debtor, you will be asked, PROCESS

SALES ORDERS?

If you answer Y, you will be presented with

a list of active Sales Orders. Choose from this list and the INVOICE will be preloaded with the

details.

The following is a complete list of possible fields:

Name Comments

DATE This defaults to the system date (the date at the

top of the screen). If you change it, HiFinance will retain the changed date

until you exit to the DEBTOR DATA ENTRY

MENU. If you have changed the date and wish to return to the system date,

press <F1>.

THEIR ORDER # This is a non-compulsory field used when your customer supplies

an order. This field is displayed on transactions and is printed on the INVOICE.

INVOICE # By default, HiFinance will add one to the last INVOICE number used and present this to

you. If you have set the option, you may then manually enter a number. As this

is your reference to the INVOICE,

you should avoid using duplicate numbers.

DEBTOR’S NAME If you are invoicing the Debtor SUNDRY,

HiFinance will ask you to enter the actual name of the Debtor. The sundry

Debtor is treated differently from other Debtors in that it can be singled out

for exclusion in certain reports. The modified name will be printed on the INVOICE and displayed in DEBTOR ENQUIRIES but will not be saved

to the Debtor master-file record.

SALESMAN # This field defaults to the Salesman as entered on the Debtor

master-file. If you have floating

salesmen, you can choose to change the Salesman’s code at this point. The

change will affect the update of commissions, but will not be written back to

the Debtor master-file.

TAX EXEMPTION CLAIM Here you choose whether the INVOICE

will be taxable or exempt. This is independent of any sale-tax number you may

have entered on the Debtor’s master-file record. To make the invoice exempt of

tax, enter Y.

TAX NUMBER If you have chosen to make the INVOICE exempt of tax, you must enter a value in this field. You

must either enter an exemption number or you may enter the word, EXEMPT. If you enter an exemption number all Inventory

lines will be extended without tax and will be added to tax rate 10. If you enter the word EXEMPT, tax rate 11 will be used. (See SECTION 7.2.7.)

Hint: To quickly enter the work EXEMPT, press <F1>. If you enter a sales-tax number here, it will be

written back to the Debtor’s master-file when the INVOICE is processed.

OVERALL DISCOUNT If you have chosen to allow overall discounts, you will be

asked to enter a value here. This can be any number from zero to 99.99%. This discount will not be applied if you manually

enter a price for an item or a Special Price is detected.

APPLY TO ALL LINES If you have enabled both line discounts and overall

discounts, and you have entered an overall discount, above, you will be asked

to resolve the potential clash. If you answer N here,

only un-discounted lines will have the overall discount applied. If you answer Y, the two discounts will be applied, geometrically.

At each point, you may cancel the invoice

by pressing <ESC>. However, it is possible to

return to a specific field by using <CsrUp> or <F8>.

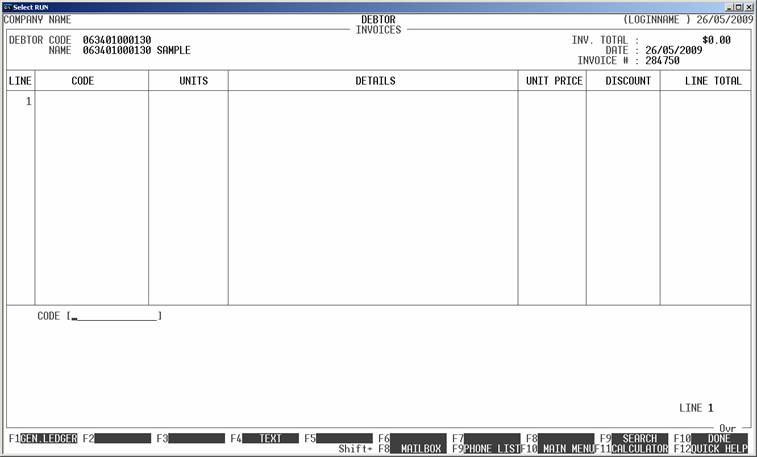

After answering these fields the screen will repaint

and display as follows. Note that at this point there is no way to go back to

the above questions, except by cancelling the invoice and starting

again.

Here you may enter the complete details of each INVOICE line. You can also change from

entering an Inventory line to a General Ledger line, Job Costing line (if enabled)

or a Text line. The fields displayed depends on which type of line you are

entering and what options you have set in SYSTEM

DEFAULTS. For Inventory lines, the following fields will be asked:

CODE This is the Inventory Code. You may enter a code here

or press <F9> to initiate a search. You

can change to a different kind of entry by choosing a function key. If you

choose to enter a General Ledger line, HiFinance will remember the last code

you entered (as long as you do not exit the program). If the last line was not

zero, you can repeat the last line by pressing <F1>.

DETAILS Here you have 2 lines to enter the description of

the item. By default, HiFinance will insert the description as it appears on the

master-file. If you choose to enter a General Ledger line you can only enter

one line of description, however, HiFinance will remember the last description

you entered (as long as you do not exit the program). If the last line was not

blank, you can repeat the last line by pressing <F1>.

Also, if you have used this General Ledger account before (and have updated the

transaction) you may press <F9> to bring up the history of

details you have used before. There are up to 20 unique lines saved. Scroll

down to the one you want and press <F10> or <Enter>. The description will be automatically loaded and

you can the changed it if you wish. The new details line will be saved back to

the history file, when the transaction is updated.

UNITS You may enter any number of units, with up to 3

decimal places. Normally you should not sell more stock than you have and

HiFinance will stop you. You can downgrade this error to a warning, or suppress

it altogether by choosing the appropriate options in SYSTEM PARAMETERS. Generally, it is not recommended to cross

the zero stock level, as this can create problems in calculating cost-of-sales.

For further details, contact your dealer. If you need to calculate the number

of units, you may use <F9> to launch the calculator.

The result of the calculations will be automatically inserted into this field.

If you are invoicing the Inventory item SUNDRY, the warning is suppressed.

Note that normally

you cannot enter zero number of units. This test is not made if you are

invoicing from a Sales Order. Allowing zero units sold enables you to show

that a particular line has been back-ordered, on the Invoice. If you choose to

show back-orders, it is also necessary for you to answer N when the question IS THE ORDER

COMPLETE, is

asked, at the end of the Invoice. If you tag the Order as being complete,

HiFinance will remove it from any back-order reports, even though the line has

not been completed.

COST-OF-SALES This field can be used to manually override the

value of Cost-of-Sales. Normally, HiFinance computes the cost value of the item

being invoiced. If this field is enabled, the computed value is displayed and

it can be over-written. This option can be either suppressed or it can be used

to enter a “per-unit” value or a “total value”. The exact behaviour is

determined by the options in SYSTEM

DEFAULTS, see SECTION

7.1.2. Note that if you are invoicing the Inventory item SUNDRY, the option is forced on.

PRICE HiFinance will insert the price from the Inventory

master-file, based on the Debtor’s price code. If you need to calculate the

price, you may use <F9> to launch the calculator.

The result of the calculations will be automatically inserted into this field.

If you wish to see all the available prices, press <F1> and then choose a number or function key to insert

the price. Alternatively, you may override the price manually. If there is a

note on file for this Debtor <F4> will be available to allow

you to display this information. Similarly, <F6> will display any Billing

Address and <F7> will display any Delivery

Instructions.

DISCOUNT If you have chosen to enable line discounts, you

will be able to enter the value here, as a percentage. If the Debtor has a

default discount rate attached, HiFinance will automatically enter it here.

Note that the discount will not be entered automatically unless the field is

initially zero and you have changed the unit price or if a special price has

been detected. If you then wish to enter, or override, the line discount, you

will have to do it manually.

TAX RATE Normally, HiFinance will pick-up the tax-rate from

the Inventory master-file record. If you sell at varying rates, you can

override the rate here. If the customer is claiming a tax exemption, you may

not change the rate.

TAX BASIS Normally, HiFinance will pick-up the tax-basis from

the Inventory master-file record. If you sell at varying rates, you can

override the basis here. If the customer is claiming a tax exemption, you may

not change this field.

TOTAL HiFinance will automatically compute the line total.

If the price was zero, you will be able to enter a sale price here. This is the

total line value. If you choose to enter a value here, the discount will

be set to zero and HiFinance will automatically compute the unit price.

At each point you may press <ESC> to abort the line or the whole transaction.

If you have entered at least one line, you may press

<F5> (at the CODE field) to enter the REVIEW

function. This function allows you to view your entries, and if necessary change

or delete a line. To move between lines use <CsrUp>, <CsrDn>, <PageUp>, <PageDn>, <Home> and <End>. If there is a particularly large number of lines,

you can also use <F9> to go to a specific line number.

To modify a line, make sure it is displayed in full in the bottom window and

press <F3>. You can then re-enter any

of the details. To leave the REVIEW function, press <ESC> or <F10>, once.

To end your lines, press <F10>. You will be asked to confirm that you have

finished entering lines and then you will be asked certain trailer information.

Most of these fields may be turned off. A Complete list follows:

COMMISSION RATE This field defaults to the nominal commission rate as it

appears on the Salesman file. You may override the value for this invoice.

CARRIER You may enter a carrier’s name here. It will appear on the

invoice in the appropriate box. If you have set-up a list of Carriers, you can

use <F9> to look-up the Carrier and

load it from that table. (See SECTION 7.2.1.4.)

FREIGHT CHARGEABLE If you wish to charge freight, enter the value here. It will

automatically be posted to the Freight Chargeable account in the General Ledger

and will be separately totalled on Invoice reports.

CHANGE DELIVERY

INSTRUCTIONS HiFinance will pick-up the delivery address

saved on the Debtor’s master-file. If you wish to change it for this invoice,

answer Y.

CHANGE DELIVERY ADDRESS HiFinance will pick-up the delivery instructions

saved on the Debtor’s master-file. If you wish to change them for this invoice,

answer Y.

At the end of the INVOICE, you will be presented with a summary and you will be asked

to confirm the update. This is the point of no return. Once you answer Y,

HiFinance will update all the relevant files. Up to this point you can cancel

or modify the details. After you have updated the INVOICE, you can only remove it by entering a CREDIT NOTE.

After the invoice has updated, you can choose

to print the document and/or enter a RECEIPT.

Afterwards, you will be returned to the Debtor code entry screen where you may

either enter another INVOICE or

press <ESC> to return to the DEBTOR DATA ENTRY MENU.

Files updated by the Invoice program:

Debtor

master-file: The total of the sales and

cost-of-sales is posted to the Debtor’s record. In the case of a

Debtor/sub-account relationship, the outstanding balance is posted to the

parent account only. However the sales are posted to the actual Debtor, which

might be the parent or sub-account.

Debtor

Group file: The totals posted to the

Debtor are mimicked in the Debtor Group file. This allows you to quickly view

the sales for a group without having to generate a report.

Salesman

file: The totals posted to the Debtor

are mimicked in the Salesman file (before tax). This allows you to quickly view

the sales for a Salesman without having to generate a report.

Debtor

transaction file: Each Invoice

generates a transaction. This can be viewed in DEBTOR ENQUIRIES and is used to create reports, such as DEBTOR STATEMENTS.

Orders

file: If you have created this

Invoice from an Order, the order is updated with the current sales (units). If

you have instructed HiFinance that the Order is complete, it will be tagged as

such and can be purged by the pack program.

Invoice

image file: Every Invoice creates an

print image on disk. This is then used to print the Invoice. You can either

print the image at the time you create the Invoice or you can use the DEBTOR ENQUIRIES program to print (or

re-print) an Invoice.

Invoice

print-file: If you have chosen not to

print invoices during the update phase and you have chosen to batch invoices

(see SECTION 6.1.2)

an entry in the Invoice Batch Print file is made for each invoice. You can the

print the Invoice using the PRINT

INVOICES function (see SECTION 1.3.8.1).

Inventory

master-file: Each Inventory line

updates the relevant Inventory record. The sales and cost-of-sales is posted to

this record and may be viewed in INVENTORY

ENQUIRIES.

Inventory

Group file: The totals posted

to the Inventory item are mimicked in the Inventory Group file. This allows you

to quickly view the sales for a group without having to generate a report.

Inventory

Location file: The totals posted to

the Inventory are mimicked in the Inventory Location file. This allows you to

quickly view the sales for a Location without having to generate a report.

Inventory

transaction file: Each Inventory line

generates a transaction. This can be viewed in INVENTORY ENQUIRIES and is used to create reports.

Jobs

master-file: If you are using the

Job Costing option, you can invoice Jobs. If you do, the Job master-file will be

updated with the value of WIP you have entered. If the WIP total becomes zero,

you also have the option to tag the Job as complete.

Jobs

transaction file: Each Invoice

line that is attached to a Job generates a transaction in the Jobs

transaction-file. This can be viewed in JOBS

ENQUIRIES and is used to create reports, such as JOB TRANSACTIONS.

General

Ledger master-file: This is

updated in two ways. A) if you post a line directly to General Ledger, the

value will be posted to the relevant account. B) in addition to this several

accounts are automatically posted to, eg Sales, Cost-of-sales (as defined in

the Inventory Group), GST, Discount, Trade Debtors and Stock-on-Hand. Jobs post

to Work-in-Progress (WIP) rather than Stock-on-Hand These accounts must be

defined in the GENERAL LEDGER CONTROL

ACCOUNTS.

General

Ledger transaction-file: A transaction

is posted for each General Ledger transaction line and for the totals described

above.

Extension for United Shipping:

The

following only refers to United Shipping and the special modification for this

site.

Each product for sale must be setup as a Bill-of-Materials item. The individual components are never sold separately, but some are purchased. Other non-BOM items are invoiced normally, but there will not be many of these.

Each BOM must contain exactly 3 items. These must

contain:

a)

An item of excise. This contains the excise unit value and must be

attached to a group called EXCISE.

b)

An item of terminal charges. This contains the terminal charge for the specific

fuel and must be attached to a group called TERMINAL.

c)

Another item, not in the above groups.

For instance, ULPT might be made up of ULP, EXCISE10 and TERMINAL1. Only ULPT would be sold, and only ULP

would be purchased. These example stock codes will be used in the description,

below.

When a BOM item is invoiced, the program checks that

the 3 way setup, above, is strictly adhered to, and then will allow you to

invoice the Assembly (the product actually being sold). In the above example, ULPT. It is important that the option to update BOM

through Debtors be enabled.

Update will proceed as follows:

The

COS for ULPT will always be the same as

the sell price. This will update the stock files for ULPT.

A unit of ULP, EXCISE10 and TERMINAL1 will be sold for each unit

of ULPT. The units in the BOM record are ignored.

COS in the General Ledger will show the full for

wherever ULP is pointing and the partial values for wherever EXCISE10 and TERMINAL1 are pointing. (Note that

the Sales pointer in the EXCISE and TERMINAL Inventory groups, are ignored.)

SALES goes to the Sales pointer in the ULPT’s Inventory group, as per normal, and all other

values update the General Ledger in the normal way (eg Trade Debtors, etc.).

The purpose of this modification is to allow one

line to appear on the invoice, but the components to be split in the General

Ledger. It also means that stock can be sold before it is purchased. Any

discrepancy in ULP’s sales value (in Inventory)

will have to be taken up in a stock losses account. Similarly, dips of the

storage of ULP are adjusted to a stock

losses account in the General Ledger.

Extension

for Foreign Currency

If your

installation has the Simple Debtor for Foreign Currency option enabled, you

will be asked (during printing) if you would like to print in a Foreign

Currency. For this option to work, the invoice must not have GST and it must

only have one line and it must be a General Ledger line. When printing, you

will be asked for the Foreign Currency unit (which must be the Foreign Currency

Table) and the Foreign Currency total. The rate will be computed backwards and

saved in the Foreign Currency Table. Enquiries will display the Foreign

Currency value, if it exists. Note that reprinting will allow you to override

and change the V fields (including cancelling it out altogether). The Debtor

will still have the value in $A.