HiFinance

5

SECTION

7.1.7 - END-OF-YEAR

USAGE: To clear old transactions and shift balances to

start a new financial year. If you do not run END-OF-YEAR, eventually you will not be able to enter new

transaction because you will run out of accounting periods to enter them

into. END-OF-YEAR should only be run

after you have entered all transactions for the old financial year. Once you

run END-OF-YEAR, the calendar will

shift and last-year will be deemed closed.

Hint: Because this process deletes old transactions,

now would be a good time to run a transaction report of any old transaction

(more than 2 years old) and to take a permanent backup.

DISCUSSION:

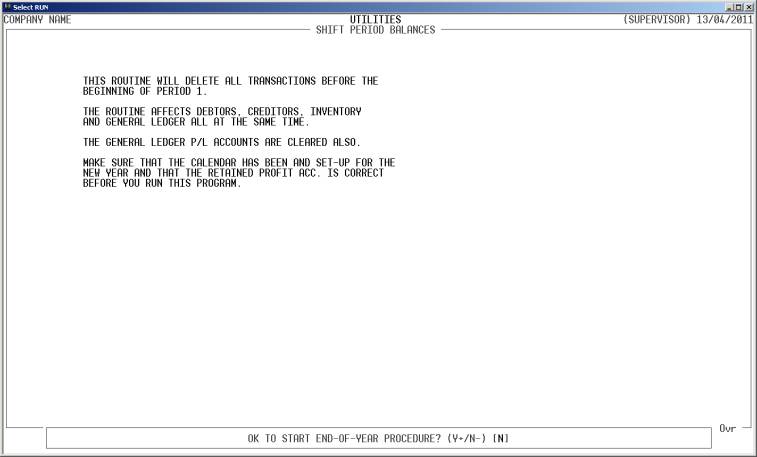

When you start END-OF-YEAR you are presented with the

following warning:

It is important to read and

understand this message. Once this program is run, transactions are lost from

the system and the only way to go back is to restore from backup.

Note that confirmation is asked for several times in

this procedure. Sometimes the answer required is a simple Y or N, other times it is

specifically YES. This is deliberate.

End-of-Year is a non-reversible procedure and it is imperative that you follow

the instructions precisely and understand each step. Also, this was done so

that you are less likely to run End-of-Year accidentally.

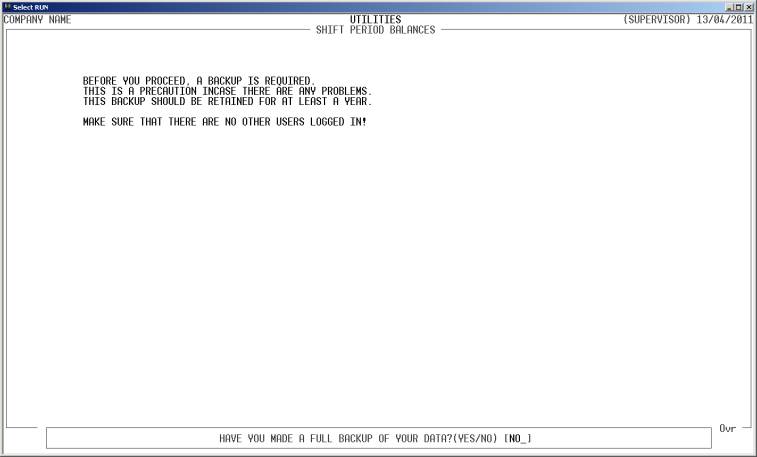

The next screen reminds you that you need to make an

End-of-Year backup. We recommend that you keep this backup for tax and other

purposes, in case you have to restore and reconstruct information from previous

years. As with other backups, you should keep the backup media in a safe place.

Normally, the End-of-Year backup is stored off-premises, unless you have a

fireproof safe or some other safe method of long term storage.

You are also reminded that the if you are in a

multi-terminal environment, End-of-Year procedure should be run when

no-one else is using HiFinance. If not, certain files may not update

correctly because they might be locked by other users making enquiries. Also,

anyone updating files during End-of-Year might end up with half updated files,

or worse, corrupt indexes. This is advice also applies to making backups.

To abort the procedure at this point, enter NO. If you answer YES, you will be asked, HAVE YOU UPDATED THE CALENDAR? This is a convenient point

to enter the calendar program. If you reply N you will be taken to the

calendar program and then returned. If you are sure that you have

updated the calendar, you may enter Y.

Next you will be asked:

WHAT DATE DID PERIOD 1 OF LAST YEAR BEGIN?

[01/07/1997]

TRANSACTIONS BEFORE THIS DATE WILL BE DELETED.

Read the

question carefully. The date you enter here will dictate which transactions are removed

from the system. Any transaction (except unallocated Debtor and Creditor

transactions) before this date will be removed from the system. If the

calendar is correct and you are running standard monthly periods, the default

entry will probably be correct.

The final question is the point of no return. After

you answer YES, the process will start and

continue automatically.

Hint: Again remember to make sure that no other uses are

trying to update any transactions because they will be locked-out. Also, it is

best not to let any other users enter enquiries or reports while END-OF-YEAR is proceeding as this might

give false results or might lock the system.