HiFinance

5

SECTION 1.4.5.1 -. DEBTOR STATEMENTS - BY PERIOD

USAGE: These Statements are sent to your customers as a

record of the month’s activities. Statements can either be a list of

outstanding transactions or a full list of current transactions. Current

business practices normally only require the first option because this creates

fewer Statements and less paperwork.

DISCUSSION: This function always prints in Debtor Code order.

When you enter this program, the following questions

will appear:

STATEMENTS FOR:

YEAR [ ] (L)ast, (T)his or

(N)next year. PERIOD [..] Statements

are generated up to a period. By default, this is the current period but you

can change the period if you wish. Backdating does not undo the balances to the

status as it was at the end of that period. Eg if you

are currently half way through March and you have entered a number of receipts

that affect February, running statements for February will not give you the

balance at the end of February, rather it will give you the remaining

balance up to February. You may legitimately backdate statements if, for

instance, you are running the report at the beginning of March but have

not yet started posting receipts and you wish to see the report expanded up

to February.

Enter

a year, eg L for last year, T for this year or N for next year. Then enter

the period number, 1 - 12, within that year. Note that next year can only have periods 1 - 3.

PRINT PRIOR

TRANSACTIONS AS AN OPENING BALANCE This

option is for companies that are used to running Balance Forward accounts.

Although this is an out-of-date method, HiFinance offers the option for

backward compatibility. If you answer Y here, HiFinance will not

print any transactions prior to the chosen statement period but will instead

add up any balance still outstanding and print it as a single figure.

The default answer is N. If you have chosen the

option to SIMULATE BALANCE FORWARD

STATEMENTS (see

SECTION 7.1.2, SYSTEM ULTILITIES) this option is

forced on.

PRINT CURRENT

TRANSACTIONS IN FULL This option is normally

used in conjunction with the previous one. This option will force HiFinance to

print all transaction within the chosen statement period, even if they have

been paid. This can give some interesting results if not used correctly. If you

answer N here, HiFinance will only

print a current transaction if there is still an outstanding balance on that

transaction. The default answer is N. If you have chosen the

option to SIMULATE BALANCE FORWARD

STATEMENTS (see

SECTION 7.1.2, SYSTEM ULTILITIES) this option is

forced on.

PRINT FUTURE

TRANSACTIONS AS FORWARD ORDERS This option only relevant if you

forward date invoices. You can either choose to ignore these transactions or

have them print. If you choose Y, HiFinance will print the

transactions without adding their value into the outstanding balance. The

transactions will be tagged as * FORWARD

TRANSACTIONS - NOT YET DUE. The default answer is N.

PRINT PURCHASE

SUMMARY ON STATEMENTS If you reply Y here, HiFinance will add up the Invoices and Credit Notes, the

Receipts and the Adjustments in the current accounting period and print

a summary of at the end of each statement. This is can sometimes reduce

enquiries from your clients.

PRINT SUNDRY

DEBTOR The special Debtor called SUNDRY can be excluded from Statements by entering a N here. This is particularly

useful if you have chosen to print the current transactions in full.

INCLUDE DEBTORS

THAT HAVE A ZERO BALANCE If you answer N here, HiFinance will ignore any Debtor that has a zero balance, even if there have been current transactions. This

option can also be simulated by choosing the appropriate TOTAL BALANCE RANGE as discussed below. This should not be used

as substitute for allocating receipts as un-allocated transactions are not

removed at the end of year. The default answer depends on how you have answered

the preceding questions.

INCLUDE ALL

DEBTORS If you do not wish to set any limits on the

report, enter Y otherwise enter N. If you enter N, you will be asked a list

of further questions. HiFinance will always exclude any Statements that do

would print without a balance or transactions.

The following question asks you to enter both a

lower and upper limit. The upper limit must not be less than the lower limit.

The default answers define the extreme limits of the field. You do not have to

change all of these limits. Only change the ones you wish to, and tab past the

others.

CODE RANGE This is the Debtor’s code. If you press <F9> you will be able to search for a Debtor. If you

choose a Debtor, the code will be entered into both the upper and lower limits

of this range. This is a quick way to print a statement for one Debtor.

GROUP RANGE This is the Debtor Group.

NAME RANGE This is the first 10 characters of the

Debtor’s name.

POSTCODE RANGE This is the postcode. For this to work, you

must use the postcode field on the Debtor’s master-file.

OTHER KEY RANGE This may appear as a different literal depending on how

you have defined the field in SYSTEM

PARAMETERS.

SALESMAN RANGE This is the salesman code as it appears on

the Debtor master-file (not the transaction file).

TOTAL BALANCE

RANGE This is the range of

Debtor balances you wish to include. You can specify that only customers who

owe you money be included by entering limits of $0.01 to

$999,999,999,99. Alternatively, you may

wish to exclude customers below a higher dollar range.

To start the report, press <Enter> through each field or simply press <F10>.

Special End-Of-Month Extension for Cards

The following is a description of the procedure used

in Cards system. The following screens, etc do not

appear unless the cards option is enabled at your site.

Before beginning the process, ensure that

- All $25 Dishonour Journals for the month are

entered (Mario).

- All Manual Vouchers submitted from sire are

process by 11AM on the 1st business day of the month.

- Once the Manual Vouchers are entered, check

that the Unmanned Transactions are updated and that there is a full

reconciliation of Unmanned and Inventory. Aim for 4PM on the 1st

business day of the month.

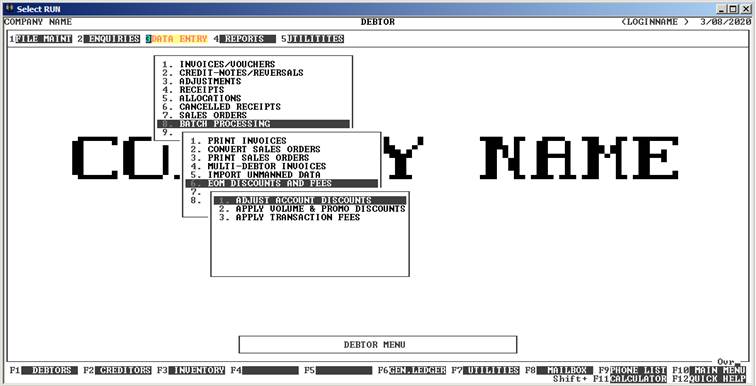

Once this is complete, use the END-OF-MONTHS DISCOUNTS MENU (see SECTION 1.3.8.U6), to adjust the discounts

for each customer; apply volume and promo discounts; and apply transaction

fees. To reach this option, press <F1>, then 3, 8 and 7.

Most charges are computed at end-of-month, once all the transactions have been

up-loaded and applied, so these functions must be run after the last day of the

month and before the STATEMENTS are

run.

The functions on this menu must be run in

sequence and once, only. The running of these functions is covered in their

respective menu pages. See SECTION 1.3.8U.6.1, SECTION 1.3.8U.6.2 and SECTION 1.3.8U.6.3.

Once this is done, you can run the Statements,

proper. Note that, if you have forgotten to run the two programs, as above,

HiFinance will probably detect this and ask you to run them. The procedure for

EOM is as described above, for normal STATEMENT BY PERIOD. However,

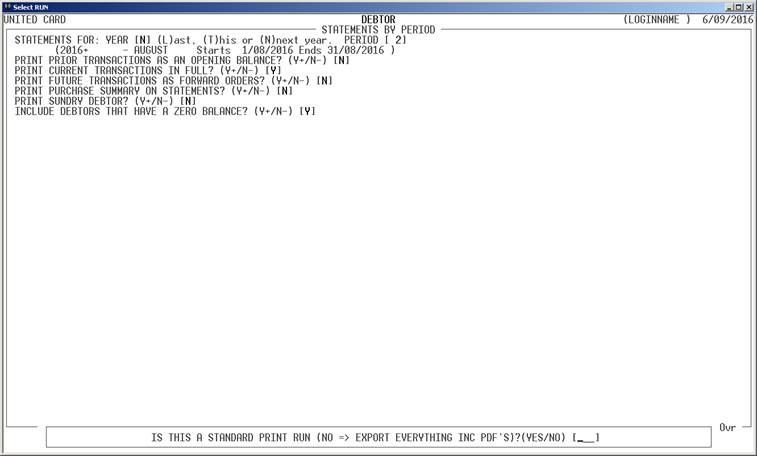

there are a few extra questions that will appear:

Note that the year and period are for the month just

closed. If you run the statements before the 10th of the month,

HiFinance will automatically enter the correct values. The values for the other

fields can be taken as correct, ie just accept the

default values.

The last question on this screen is:

IS THIS A STANDARD PRINT RUN (NO => EXPORT EVERYTHING INC PDF'S)

If you are running an EOM, you must answer NO. This is very important because answering YES will cause HiFinance to assume that you are printing one or more INVOICES for non-EOM purposes. No updates will be made to the Web Site. So, for EOM, answer NO. If you did not answer correctly, none of the following will happen.

You will be asked:

RUN THE FUELTRAC EXPORT PROGRAMS NOW

If you have not run the FUELTRAC export, you can run

it now. The default answer is Y. The only time you should

answer N is if you have already run

this report or are restarting the statements and have already answered Y before. It is important that the FUELTRAC export is run at the same

time as the statements, so that the totals presented in this file exactly match

the Statement. The export file is downloaded and manually sent to the relevant

customers. (Mario). The FuelTrac export can take a

while to run, depending on the number of customers on the list and their

activity. While it is running, a counter will appear on the screen. If you

accidentally bypass this function, you can still run the export manually (see SECTION 1.5.9U.3), however you must make sure that no

transaction are entered into the closed month or the totals will not match and

you will have to reconcile the exports to the Customer.

Finally, you will be asked if you wish to start the STATEMENT RUN. Reply Y.

HiFinance will write 2 files to the directory h:\ftp_scripts.

(This directory is setup in the SPECIAL DIRECTORIES function See SECTION – 7.5.5) but should not be changed without

consultation with IT.) Writing these 2 files will cause the Scheduler and

Report Server to pause. HiFinance will display the following warning: SCHEDULER AND REPORT SERVER HAVE BEEN PAUSED. This is to remind you that

while the statements are being generated, all printing is paused and no

transactions will be imported from anywhere (eg PCE,

Q/Fuel, etc.) If the statement program is cancelled before it completes, you

must advise IT to delete these 2 files. Otherwise the two functions will remain

disabled.

HiFinance will now scan through the debtor file and

generate an invoice for every customer that needs one. This means that

customers that have a non-zero balance, or have had transactions in the

relevant month will have a statement/invoice generated. HiFinance will

automatically determine if this invoice is printed, faxed or emailed, unless

the STATEMENT TYPE field is set to A. In this case, the program

will pause and require you to tell it how to proceed. It is recommended that

none of your customers be set this way. Also, a statement is produced (in PDF

format) for every live customer even if the totals are zero.

Once HiFinance has finished generating all the

relevant files, the message THE SCHEDULER

SHOULD NOW BE RUNNING will appear. This is to remind you that the transaction import

programs have been reactivated. You will then be asked you will be asked:

ARE YOU READY TO START PRINTING INVOICES

You must answer Y to proceed. The screen will

display the message THE REPORT SERVER

SHOULD NOW BE RUNNING and printing should start. (Please note that, as there is a bug in the

Report Server, printing may start immediately. The only downside of this is

that someone has to be around the whole time to make sure that the printer does

not jam.)

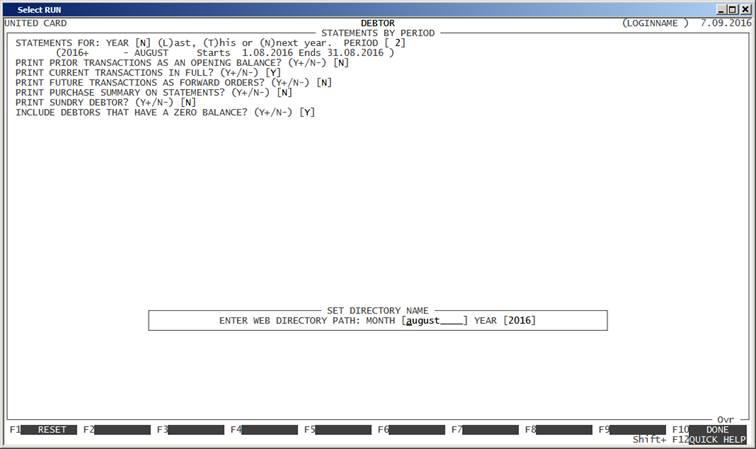

The next function refers to the placement of the PDF

files into the Web Site. You must enter the correct month and year so that

HiFinance can transfer the files to the correct directory in the Web server.

The screen appears as follows.

There are 2 fields you need to enter. The first is

the name of the month you are running the statements for and the second is the

year. By default, HiFinance should compute the correct values, so you should

just be able to press <Enter> twice, or <F10> to continue. The month should be in lower case and

the year is in 4–digit format. HiFinance combines this information to determine

the exact directory it will send the PDF’s to when transferring to the ISIS

server. If you have messed up the values, press <F1>

to reset to the default.

Having entered this last piece of information,

HiFinance will return you to the MAIN

MENU. In the background, the PDF’s are created and transferred to the ISIS

server. This can take many hours. So the Web pages will not become live

immediately. If the Statements are run at the end of the day, for instance, the

Web will be updated overnight. If you run the Statements in the morning, the

Web will probably not be completely updated till that evening.