HiFinance

4

SECTION

6.5.4 - PRIOR YEAR JOURNALS

USAGE: To enter transactions after the end-of-year has

been run.

DISCUSSION: HiFinance’s calendar spans 27 periods. This allows

for 12 months of last-year, 12 months of this-year and 3 months into next-year.

Assuming that your financial year ends on 30th June, some time after

1st July you will need to run an end-of-year. This will move all the

balances and remove old transactions. It will also close-off your ability to

post to the year just ended. Normally you would hold off running EOY for a few

weeks, to allow for any late invoicing, purchases and bank statements. Also,

you may not receive all your depreciation information, etc. from your

accountant for several weeks after the end of the financial year. To

accommodate this, HiFinance allows you the 3 months into next year before

forcing an EOY.

Most companies can have their accounts up to date by

the end of September allowing a normal EOY. Occasionally, new information is

presented. Some companies are part of a large structure that will not be

finalised for several months into the next-year. Some external accountants are

slow in providing information.

As you are forced to run an EOY by the end of

September, HiFinance includes a facility to post backwards into last-year. This

should be used sparingly because it affects any reports you may have already

printed, especially Profit/Loss and Balance Sheet reports. Any reports already

printed become redundant.

This facility only allows entry into the General Ledger.

Debtor and Creditor information is not affected.

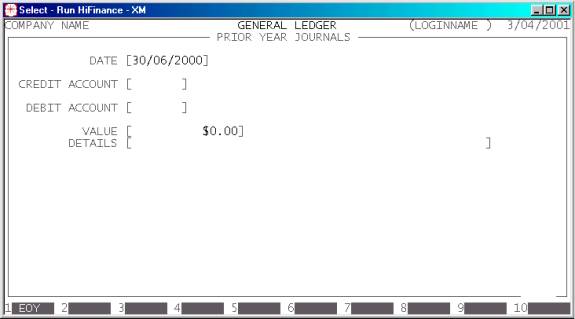

When you enter the program, you are presented with

the following screen:

The fields to enter are:

DATE This is the transaction date. Normally this will be

30 June of last-year. You can force that date by pressing <F1>.

CREDIT ACCOUNT This General Ledger account is credited from, i.e. the transaction

value will be subtracted from this account. If you cannot remember the account

number, press <F9> to initiate a search.

DEBIT ACCOUNT This General Ledger account is debited to, i.e. the transaction

value will be added to this account. If you cannot remember the account number,

press <F9> to initiate a search.

VALUE This is the transaction value. It is always a positive

number. The transaction sign’s are dictated above. You can use <F9> here to enter the calculator function. If you do,

the result of the calculation will automatically be inserted into the VALUE field. <F9> is only live when the

cursor is on this field.

DETAILS You must enter something here. This field describes the

nature and reason for the journal.

To update the journal, press <F10> or <Enter> after the last field.

HiFinance will update the two accounts and, if

necessary, find the Last-year’s profit transaction and rewrite it with the

correct figure. Last-year’s profit is only affected if you journal from a

Profit/Loss account to a Balance Sheet account.