HiFinance

4

SECTION 2 - CREDITOR MENU

The Creditor sub-system is designed to maintain

current supplier information is respect of the value of purchase and

outstanding amounts payable, together with purchase orders. Account transaction

details are maintained in an open-item format. In this format, transactions are

kept until fully matched by a balancing contra-entry, usually a payment. If you

have the CRM options enabled, access is also available to that, via the functions

available in Creditors.

Transactions are kept for at least 2 years or until

they are fully matched, which ever comes last. Balances are also maintained for

each of 12 last-year periods, 12 this-year periods and 3 next-year periods. In

this way, comparisons for purchases, etc. can be made between this year and

next year. The 3 next-year periods allow you to keep processing without forcing

an end-of-year, for at least 3 months after the end of the current financial

year.

When goods are received from customers, a service

purchased or a job performed, a purchase will be prepared on the computer.

HiFinance automatically post the relevant information to the appropriate

Creditor account and the purchase statistics, account status and, in the case

of purchase of goods, the relevant Inventory accounts. These files are updated

without further intervention of the operator.

A Creditor-by-Product Purchase Analysis allows the

user to analyse the quantity and value of each product purchased from each

Creditor over the current month, or any other period.

The Order Analysis displays details of all purchase

orders by supplier or by product, in order date or due date sequence. These are

kept on file until the order is labelled as complete.

Payments and adjustments can be aged to any balance.

It is recommended that the take-on of the Creditor sub-system

be commenced at the start of a financial month, not partway through a month.

This will facilitate audit control and balancing.

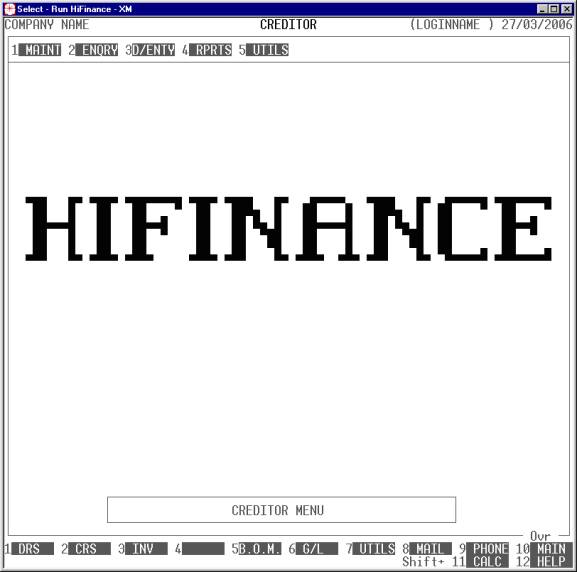

The CREDITOR

MENU is accessed as item 2 or <F2> from the MAIN

MENU. On selecting this menu the following menu will be displayed:

To return to the MAIN MENU, press <ESC>.

Fields

available on the CREDITOR MASTER file.

Name Comments

CREDITOR CODE This is the Creditor’s code. This is the code by

which the Creditor will be referenced throughout HiFinance. It is an

alphanumeric string from 1 to 15 characters long, without any leading or

imbedded spaces. Please refer to APPENDIX A for a discussion of the ASCII collating

sequence.

NAME The name of the Creditor. It may be up to 50

characters long. This field must not be left blank.

PERIOD BALANCES These are the account balances for each by period

for this Creditor. They are the amounts still outstanding in each period.

PURCHASE TOTALS HiFinance maintains a total of purchases for each

accounting period. These are not normally displayed on the screen but may be

viewed in reports. A quick way of viewing these totals for a single Creditor is

to print the Creditor’s details in CREDITOR

ENQUIRIES.

ADDRESS This is a group of 4 fields (including post-code) that

allow you to insert the Creditor’s address. Use the third line for suburb or

county. HiFinance will print these fields on reports.

CONTACT Insert the main contact’s name here. This field is printed

on the AGED ANALYSIS report as a

quick reference.

PHONE NUMBERS Here you may enter the work, home, Fax and Mobile phone numbers

of the contact person. This is useful, quick reference information. This information

is not included on any standard external reports.

EMAIL This allows you to insert the Creditor’s email

address.

GROUP This allows you to insert the Creditor into a

Creditor Group. Many Creditor reports may be sorted and totalled by Creditor Group.

See also SECTION 7.2.3

- CREDITOR GROUP MAINTENANCE.

OTHER KEY1, 2 & 3 This allows you to insert the Inventory item into

any of 3 user-definable groups. Many reports can be sorted and totalled by

these fields. These field will allow any code to be entered in upper or lower

case. Care should be taken because searches and sorts will place the lower case

entries after the upper case ones, eg a will come after Z. The name of this field may be changed in SYSTEM DEFAULTS, see SECTION 7.2.

LAST PAYMENT ON / FOR These are quick reference fields. They are displayed during ENQUIRIES. HiFinance automatically

maintains them when transactions are entered. You cannot change these fields

manually.

PAYMENT WITHHELD If you set this field to Y, the BATCH PAYMENTS (see SECTION 2.3.4.2) program will ignore any transactions

for this Creditor. If you only use SINGLE

PAYMENTS (see SECTION

2.3.4.1), this field is purely documentary.

PAYMENT PRIORITY This can be used as a documentary field but certain reports

allow you to mask for a specific priority, eg you may wish to report on only

high priority Creditors. This field must be a number between 1 and 3, inclusive, where 1 is the highest priority and 3 is the lowest.

OVERALL DISCOUNT This field allows HiFinance Purchasing to

automatically insert a discount.

GST TYPE This matches the GST TYPE when entering a Purchase. Here you

can enter the default value for each Creditor. I.e. if a Creditor normally

gives you invoices that include GST on each line, you can enter a 2 here and

the purchase will default to this, also. (See also Purchasing).

ABN This field allows you to enter the Supplier’s

ABN.

MINIMUM ORDER This field allows you to insert a value representing the minimum

order value this supplier expects. Certain programs warn you if the value of

the order is not at least this value. The value is ex-tax and before freight

(freight being the internal freight field, not a manual g/l freight line).

PRINT INVOICES This field is normally N. If you have a supplier

that does not give you invoices (eg a commission agent) you will need to

generate an invoice on their behalf. This is compulsory if they are charging

GST but pay also be useful even if they do not. If you enter a Y here, a RECIPIENT GENERATED INVOICE will be generated each time

you enter a purchase. If you enter A, you will be asked at the

end of each Purchase.

PRINT REMITTANCES or REMITTANCE TYPE This

field may have one of two headings. If you are not using the Report Server

software, you only have the option of answering Y or N to PRINT REMITTANCES. The normal answer is Y but if you have a Creditor who should never receive

remittances, enter N here. If you are using the

Report Server software you have more choices. You may still enter N for Creditors who never should receive a remittance, but you can also

specify how the remittance should be generated. You may enter P for by-printer, F for by-fax, E for by-email or A if you wish to be asked

when the remittance program is run. (Note that Y is not

an option.) The last option is used for suppliers who might sometimes require

faxes, sometimes emails, etc but for whom you cannot specify absolute values

until the remittance is actually run. The last option can make printing of

remittances very slow because HiFinance will stop and ask you for each supplier

tagged in this way. However, the option is very flexible.

PRINT BATCH ORDERS or BATCH ORDER TYPE This

field only relates to printing of BATCH PURCHASE ORDERS (see SECTION 2.3.8). However, a valid value must be entered,

even if you do not wish to use the function. This field may have one of two

headings. If you are not using the Report Server software, you only have the

option of answering Y or N to PRINT BATCH INVOICES. The normal answer is Y but if you have a Creditor who should never receive a batch

purchase order, enter N here. If you are using the

Report Server software you have more choices. You may still enter N for Creditors who never should receive a batch purchase order, but you

can also specify how the order should be generated. You may enter P for by-printer, F for by-fax, E for by-email or A if you wish to be asked

when the batch update program is run. (Note that Y is not

an option.) The last option is used for suppliers who might sometimes require

faxes, sometimes emails, etc but for whom you cannot specify absolute values

until the remittance is actually run. The last option can make printing of

orders very slow because HiFinance will stop and ask you for each supplier

tagged in this way. However, the option is very flexible.

CREDIT DAYS & DOLLAR These two fields are used in PURCHASING to warn you of impending bad debts.

MODIFIED ON/AT/BY This displays the last time this CREDITOR record was

modified (eg description). It is stamped with the date, time and the usercode of person who did the modification.

NOTE This is a field that allows you to attach a comment to the account.

For instance, you might use this to store details of a dispute.

DELIVERY ADDRESS This allows you to enter a Delivery address that is different

to you head office (Billing) address. This address is printed on PURCHASE ORDERS. Note that this field

is 500 characters long. Not all formats can handle such a large field and, if

this is the case, the information might be truncated.

DELIVERY INSTRUCTIONS This allows you to enter any special Delivery Instructions.

These instructions will be printed on PURCHASE

ORDXERS. Note that this field is 500 characters long. Not all formats can

handle such a large field and, if this is the case, the information might be

truncated.