HiFinance

4

SECTION

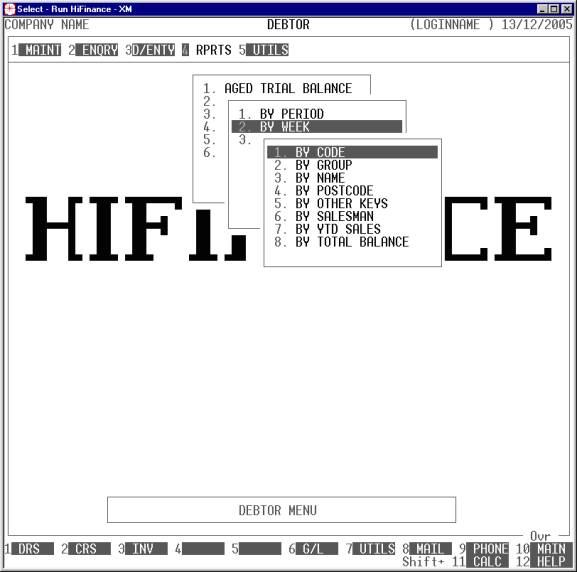

1.4.1.2 - DEBTOR AGED TRIAL BALANCE BY WEEK

USAGE: To print a list of Debtors with their outstanding balance

and a breakdown of those balances by week. This format of the DEBTOR AGED TRIAL BALANCE is designed

for companies that have a very fast turnover, eg Bakeries. Although HiFinance

is designed to work in monthly periods, you can report on outstandings on a

week by week basis, i.e. 7 days, 14 days, etc.

DISCUSSION: When you choose this report, HiFinance will

firstly ask you in which order you wish to print the balances. The screen will

appear as follows:

Choose the order you wish to print the report in by

pressing the number next to the option. If you choose to print BY OTHER KEYS, another menu will open to allow you to specify

which of the three OTHER KEYS you actually require.

The report is similar irrespective of report order,

however certain sort orders allow sub-totals to be printed (eg by GROUP). Also if you intend to limit the

report to a range of Debtors, it is more efficient to print the report in

that order, because HiFinance can then optimise the search pattern.

Note that this report can only be printed in Long

Format.

When you enter this program, the following questions

will appear:

START A NEW PAGE ON

CHANGE OF KEY Certain sort options will

sub-total at the end of each group, eg SALESMAN.

If you wish HiFinance to insert a page break at the end of each group, reply Y. Otherwise the report will flow on continuously after printing the

sub-total.

TRANSACTIONS UP TO This report is generated up to a date. By default, this is today’s

date but you can change the date if you wish. Backdating does not undo the

report to the status as it was at the end of that date. Eg if you are currently

half way through March and you have entered a number of receipts that affect

February, running the report for a date in February will not give you the

balance at the end of that date. Rather it will give you the remaining

balance up to that date. You may legitimately backdate a report if, for

instance, you are running the report on Monday for a date as at last Friday.

INCLUDE ALL DEBTORS If you do not wish to set any limits on the report, enter Y otherwise enter N. If you enter N, you will be asked a list of further questions.

INCLUDE ACTIVE DEBTORS Active Debtors are defined as those that have a balance.

INCLUDE NON-ACTIVE

DEBTORS Non-active Debtors are defined as not

having a balance. If you wish to print sub-accounts, you must answer Y here.

INCLUDE BILL-TO DEBTORS

ONLY If you do not use the sub-account facility,

this question is irrelevant. If you have sub-accounts and wish to only print

the main accounts, enter Y. To show the sales

breakdown of each sub-account, enter N.

INCLUDE DORMANT DEBTORS Normally, dormant Debtors are not included in this report. If you

wish to included them, enter Y.

The following question asks you to enter both a

lower and upper limit. The upper limit must not be less than the lower limit.

The default answers define the extreme limits of the field. You do not have to

change all of these limits. Only change the ones you wish to, and tab past the

others.

CODE RANGE This is the Debtor’s code.

GROUP RANGE This is the Debtor Group.

NAME RANGE This is the first 10 characters of the Debtor’s name.

POSTCODE RANGE This is the postcode. For this to work, you must use the postcode

field on the Debtor’s master-file.

OTHER KEY RANGE This may appear as a different literal depending on how

you have defined the field in SYSTEM

PARAMETERS.

SALESMAN RANGE This is the salesman code as it appears on the Debtor master-file

(not the transaction file).

YTD SALES RANGE This is the total sales for this year and next year,

irrespective of the period you are running the report for.

TOTAL BALANCE RANGE This is the total balance, irrespective of the period you are

running the report for.

To start the report, press <Enter> through each field or simply press <F10>.

The report itself will detail the Debtor Code,

Debtor name, Current balance and balance up to 42 days back, as well as the

total balance up to the chosen date. The contact name and number are also

printed. At the end of the report, the total of each period is printed along

with the percentage of the total balance this represents.