Total

Legal Accounting 3

SECTION

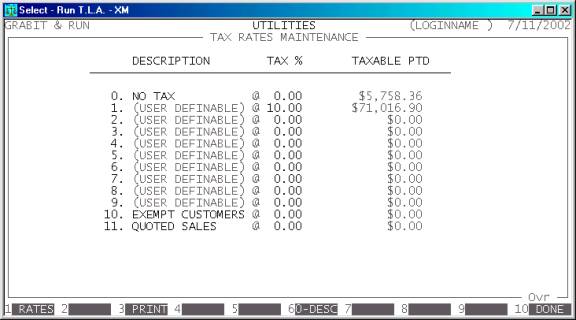

7.2.1.6 - GST RATES

USAGE: To setup and enquire on the sales-tax rates and

totals and to setup your company’s tax details.

DISCUSSION:

This function has several facilities:

a)

The

primary function is to setup the user-definable tax rates. There are 12 tax

rates available in T.L.A. These are used in BILLING.

Rate zero is always zero

percent. This can be used for items that are sold at a zero rate of tax or

for items that are sold inclusive of tax. It is confusing to use the same rate

for both.

Rates 1 through 9 are

user-definable. This means that you have the ability to set them yourself to

any value from 0% to 99.99%.

Rates 10 and 11 are used for

customers who either can claim an exemption.

To clear these totals, you must print the screen.

T.L.A. will not offer you the option to clear until you do.

b)

The

screen displays the total accumulated sales within each tax rate. This is the

total taxable value. If you multiply this by the rate, you will have computed

the tax payable at that rate.

c)

The

screen appears as follows:

The function keys are as follows:

<F1> This allows you to change rates 1-9. There is no

requirement to enter the rates in any order and you may leave any or all of the

fields blank. You should be careful not to change a rate that has non-zero

sales. This will cause confusion when printing total payable tax. When you have

entered all the rates you require, press <F10> to update the files.

<F3> This initiates a report that lists the used rates

and the tax payable. After you print the report (to the screen or printer) you

will be offered the option to clear the totals. If you do, the totals will be

set back to zero. You should do this once a month to generate a report. This is

one method of calculating GST on Clients. The other way is to view the

transactions in the General Ledger. The General Ledger also contains the

Creditor GST transactions.

<F6> Rate zero is always at a zero rate but you can

change the description. This is useful if you sell retail or inclusive of tax.

In this case, change the literal to INCL. or RETAIL or another relevant description.

<F10> or <ESC> This will

return you to the CLIENT/TRUST UTILITES

MENU. Any changes you have made will already be applied.