Pipeline

3

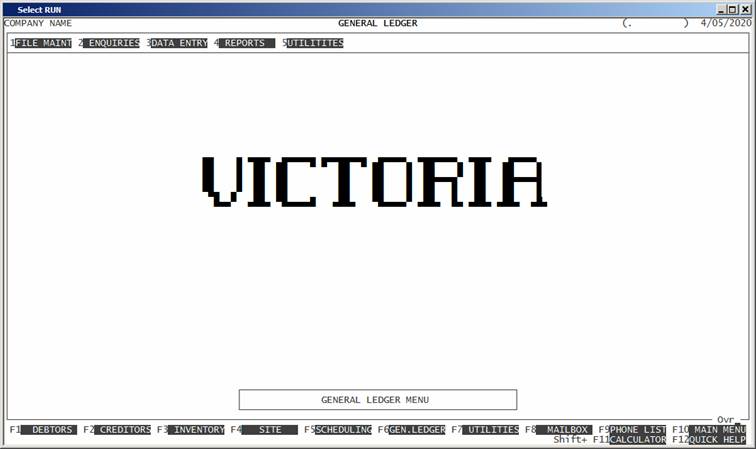

SECTION 6 - GENERAL LEDGER MENU

The General Ledger is designed for use as part of

the integrated Pipeline system. It can also be used in stand-alone mode,

although some functions, such as BANKING

must be accessed through the DEBTORS

MENU.

The General Ledger provides a means whereby the

other sub-systems (eg Debtors, etc.) can be summarised for reporting purposes.

Entries can be posted directly into the General Ledger for transactions that do

not involve Debtors or Creditors. These include Bank charges, interest

payments, Directors’ fees, etc. The information is collated and organised so

that Pipeline can produce Profit & Loss Statements and Balance Sheets.

The GENERAL

LEDGER MENU is accessed as item 6 or <F6> from the MAIN

MENU. On selecting this menu the following menu will be displayed:

To return to the MAIN MENU, press <ESC>.

Fields available on the GENERAL LEDGER MASTER file.

Name Comments

ACCOUNT CODE This is the General Ledger code. This is the code by

which the account will be referenced throughout Pipeline. It is of the format 9999. Any number from 0001 to 9999 may be used.

NAME The name or description of the account, eg. CARS. It may be up to 50 characters long. This field

must not be left blank.

PERIOD BALANCES These are the account balances for each by period

for this account. They are the sums of all the transactions posted to this

account. You cannot directly change these balances.

TOTAL YTD or CLOSING BALANCE Pipeline will display the total

of each year at the bottom of the column. (See SECTION 6.2.1.) Profit & Loss accounts

will only show the total of that year. Balance Sheet accounts show a running

balance with OPENING BALANCES at the top of each column.

EXPECTED SIGN It is normal, in a General Ledger, to show

transactions and balances as Debits and Credits, rather than positives and

negatives. In Pipeline, every transaction and carries its true sign. This means

that every Debit balance is a positive and every Credit balance is a negative.

To save clutter on the screen, you are required to enter the expected sign of

the account. This is the sign the account will normally have, eg expenses are

normally Debit accounts. The field must be D for Debit or C for Credit. Pipeline will display DB after a balance if the

balance is negative and the expected sign is Debit. Similarly, CR will be displayed if the balance is positive and the expected sign is

Credit. In either case, neither CR nor DB will be displayed if the balance is zero.

ACCOUNT TYPE This field describes to the system what type of

account this is. This information is used in certain reports and is also tested

in some transaction entry programs. The available options are: A, L, P, R, E, N, M, H, S, T and G. These stand for Asset, Liability, Proprietorship, Revenue, Expense,

Appropriation, Main-Heading, Heading, Sub-Total, Total, Grand-Total

respectively. Types M, H, S, T and G represent non-posting

accounts. They are used for reporting and internal totalling. Pipeline will

stop you from posting to these accounts.

You must take care

to not change an account from a posting to a non-posting account, if there is a

balance. If you do, the balance will disappear from reports, such as

Profit/Loss, and so will unbalance that class of reports. Move any balance to a

different account, if you intend to do this.

Sub-Total, Total,

Grand-Total will cause the Profit/Loss and Balance Sheet reports to print a

total of all accounts above that account and will reset the total. Eg if you

place a sub-total after, say, your phone accounts (assuming you have several of

these), Pipeline will print a total of those accounts. This also assumes that

you have created a sub-total before these accounts. Pipeline will total all

accounts since the last sub-total account. Totals will also reset Sub-totals

and Grand-totals will reset the other two. Each type prints in a different way

(increasingly bold). In this way, you can format the reports without resorting

to external programs, such as Excel.

DISPLAY WARNING ON USE This causes certain transaction entry programs to

display a warning that the account is not normally posted to, without actually

stoping the posting.

ASK FOR EMPLOYEE NUMBER This field is only used in certain installations to

tell Pipeline that this account should carry an employee number.

GST RATE Pipeline allows for several tax rates to be defined.

Here you define to the system, which rate is to be used. You do not enter the

percentage rate here, rather you enter the rate’s number (0 - 9) as defined in the TAX RATES, see SECTION 7.2.4. This allows you to change the

percentage rates without having to go back to every General Ledger account.

ACCEPT POSTINGS TO

GENERAL ACCOUNT If you enter N here, Pipeline will stop you from posting transactions to sub-account 0001 when posting to this account. Some processes will

allow posting with the SUPERVISOR

override.

ACCEPT POSTINGS TO SUB-ACCOUNTS If you enter N here, Pipeline will stop

you from posting transactions to sub-accounts other than 0001 when posting to this account. Some processes will

allow posting with the SUPERVISOR

override.

DISPLAY SUB-ACCOUNTS When displaying information in GENERAL LEDGER ENQUIRIES (see SECTION 1.2.1) You have the option to suppress the

displaying of sub-account totals. There are some accounts where sub-accounts

are irrelevant.

IS THIS A BANK If this account is a bank account, you should enter Y here. Otherwise enter N.

ATTACH BANK TO WHICH

COMPANY If this is a Bank, you need to enter the

Company to which it belongs to. If you attach the bank to a company that is not

the main company (ie the company that holds the cheque book) payments will

create loan account transactions between the companies on the assumption that your

bank will sweep the subsidiary bank accounts into a master account, at the end

of each day.

BANK ACCOUNT NUMBER Here you enter the bank account number or BSB. There is space for up

to 10 digits here although most bank accounts are shorter. Note that only the

last 4 digits are significant when searching for a bank account. This field is

compulsory if the account is flagged as a bank. Otherwise it is left blank.

ALLOW CHEQUE NUMBER RANGE Here you enter the lowest and highest cheque numbers you

can enter into this account. By default the range is 000000 through to 999999. However, to avoid

accidentally entering a cheque number outside the range of your chequebook, you

should enter the starting and finishing ranges of your chequebook here. You can

always change the numbers when you start a new book. Only one range can be

entered here so you cannot run two chequebooks (for the one bank) unless they

are in sequential ranges.

USED ON THE GST REPORT This flags the system to include this account in the

GST BALANCE CHECK report. (See SECTION 6.4.5.8

and SECTION 6.5.8.2.8)

WHICH COLUMN ON GST

REPORT (A-O) This flags the system as to

where on the GST report, the balance should be printed. (See SECTION 6.4.5.9.

Valid values are detailed in this section.)

DATE LAST BANKING This displays the date of the last deposit to this

account. This might be different to the last transaction date.

DATE LAST POSTED This displays the date of the last transaction to

this account.

NOTE This is a field that allows you to attach a comment

to the account. For instance, you might use this to display information

regarding the usage if the account.