HiFinance

5

SECTION

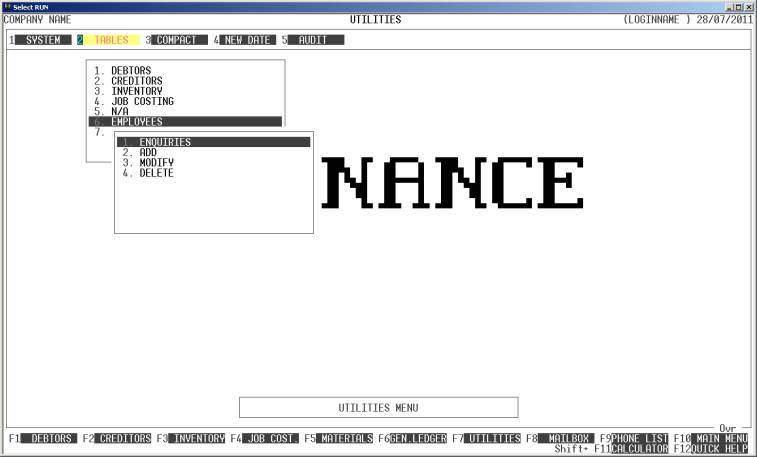

7.2.6 – EMPLOYEES MENU

If you intend to run the payroll system, you will

need to create Employees. This menu leads to programs that allow you to

manipulate the Employee master-file. Here you may view, add, change or remove

Employees. No transactions can be created from programs included in this menu.

To run the payroll you must use the PAYROLL

option, see SECTION

6.3.4. Similarly, if you intend to run the TIME SHEET entry routine in the Job Costing sub-system, you will

need to create the Employees here.

The Employee file also has fields that allow it to

be used as a simple personnel file.

The EMPLOYEE

MENU is accessed as item 6 on the TABLE MAINTENANCE MENU. On selecting this menu the following screen

will be displayed:

To return to the TABLE MAINTENANCEMENU, press <ESC>.

Fields available on the EMPLOYEE MASTER file.

Name Comments

EMPLOYEE CODE This is a number from 1 to 99. It is assigned by HiFinance

and is the code by which the Employee will be referenced throughout HiFinance.

NAME This is the Employee’s full name. It may be up to

50 character long. This field will appear on any cheques printed. This is a

compulsory field.

ADDRESS This is a collection of 3 address areas with a separate

field for postcode. If you have entered a post-code in the provided field, it

is best to insert the suburb and state in the third line. This will produce a

cleaner looking address print, eg in cheques. The address is not compulsory.

EMERGENCY CONTACT This is an optional field, which might be useful in case of an

emergency.

PHONES This is a collection of four optional fields that allow

you to separately insert numbers for Work, Home, Fax and Mobile.

TAX FILE NUMBER If provided, you may enter the Employee’s TFN here.

DATE OF BIRTH You must enter the Employee’s date-of-birth here.

DATE STARTED You must enter the date this Employee started working for your

organization.

DATE LEFT When an employee leaves, you must enter the date here. You must

also enter a note describing the details of the departure. When a date is

entered here, HiFinance will skip the Employee during a pay run.

POST SUPER TO This must correspond to a Creditor on the Creditor master-file.

Any superannuation payable on behalf of the Employee will be posted to that

Creditor.

POST TAX TO This must correspond to a Creditor on the Creditor master-file. Any

taxation payable on behalf of the Employee will be posted to that Creditor.

NORMAL HOURS This is the normal number of hours the employee works. It may

be left as zero. In either case, it can be over-ridden during the pay run.

NORMAL RATE/HR This is the normal pay rate per hour. It is a compulsory field.

NORMAL TAX If you have entered a NORMAL

HOURS figure,

you may also enter a value for normal tax. This must not be greater than the product of NORMAL HOURS and NORMAL RATE/HR.

NORMAL SUPER This is the value of superannuation you normally pay on behalf

of the Employee. It may be entered as an absolute amount or as a percentage of

income.

NOTES This is an area where you may enter unstructured

information about the employee. This field must contain something once an

Employee leaves.