HiFinance

5

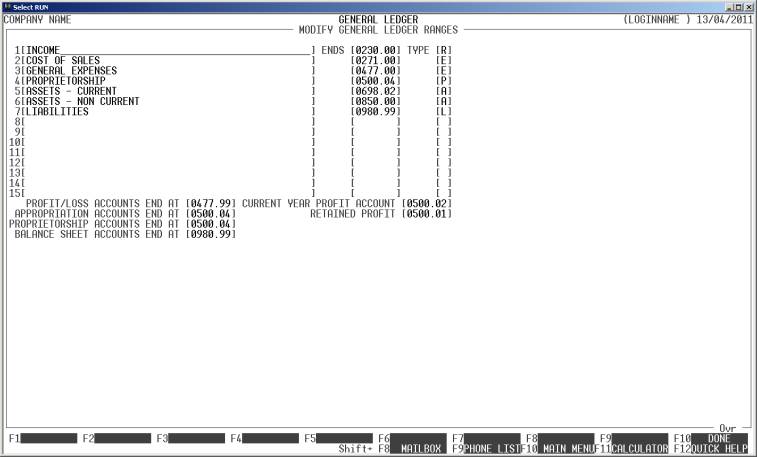

SECTION 6.5.1 - GENERAL

LEDGER RANGES

USAGE: To define the major ranges in the General Ledger chart

of accounts. Also some accounts need to be defined here to allow certain

reports to run.

DISCUSSION: The General Ledger is split up into major ranges.

The first range is usually INCOME,

followed by EXPENSES, etc. The

actual ranges depend on the structure and requirements of your company. This is

best determined by your accountant.

When you enter this function, the screen will appear

as follows:

There is space for up to 15 ranges, however it is unlikely

that you will have more than 10. Each range is defined by a 50 character

description, an upper account limit and a type. These ranges must be in numeric

order, but there are no other restrictions. The account type defines the usual

type within this range. Eg. Income is normally an R type. The available types are defined in SECTION 6. The Profit/Loss report and

the Balance

Sheet will automatically introduce major totals at account range

limits.

Apart from the above, there are also specific

accounts you need to define:

PROFIT/LOSS ACCOUNTS END

AT This defines the upper limit of Profit/Loss

accounts. The PROFIT/LOSS report will stop at this account. The entry you make

here does not have to refer to an actual account.

APPROPRIATION ACCOUNTS

END AT The Balance SHEET report

will end the appropriation section at this point. The entry you make here does

not have to refer to an actual account.

PROPRIETORSHIP ACCOUNTS

END AT The Balance SHEET report

will end the proprietorship section at this point. The entry you make here does

not have to refer to an actual account.

BALANCE SHEET ACCOUNTS

END AT The Balance SHEET report

will end at this point. Any accounts after this account will be considered as off-balance-sheet accounts. The entry

you make here does not have to refer to an actual account.

CURRENT YEAR PROFIT

ACCOUNT This must refer to an actual account. The

account is used within the BALANCE SHEET

report to total the profit for the current year.

RETAINED PROFIT This must refer to an actual account. The account is used

within the BALANCE SHEET report to

total the profit for the current year. It is also used at EOY to post the

carried forward profit. HiFinance holds two years of information. To show

profit at the beginning of the current year, the EOY routine will post a single

sided entry to this account.

To return to the GENERAL LEDGER UTILITIES MENU, press <ESC>.

Where required, enter a value into each field that

is surrounded by brackets. To move to the next field, press <Enter>. Complete your entry by pressing <F10>. If HiFinance has found no inconsistencies, you

will be asked to confirm your entries and then the General Ledger will be

updated.