HiFinance

5

SECTION

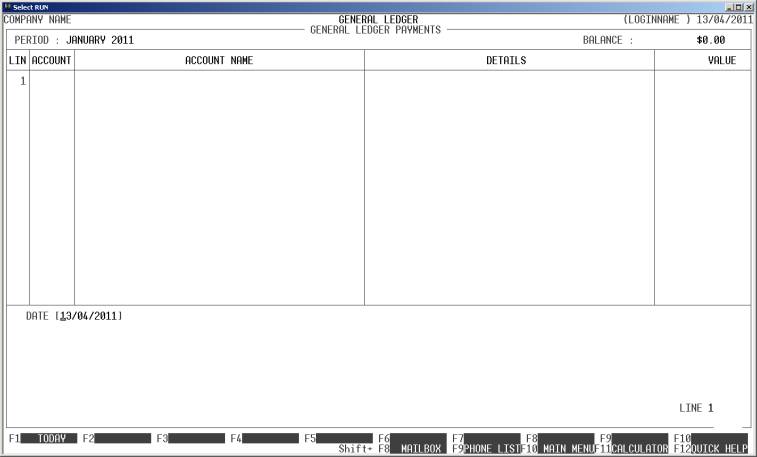

6.3.2 - GENERAL LEDGER PAYMENTS

USAGE: To enter cash payment transactions. This is the

normal method of entering payments when using the General Ledger in stand-alone

mode. In integrated-mode, it is still necessary to enter certain receipts

directly into the General Ledger, which do not relate to a Debtor, eg. rental,

overseas commissions, etc.

DISCUSSION: When you start the PAYMENTS program, the computer will initially ask:

ENTER PERIOD [_7] JANUARY 2011

Payments can only be entered one accounting period

at a time. Otherwise period based reports would not balance. By default, the

current period is offered, however you may change the period to any number from

1 to 15.

Enter the period number that pertains to the entries

you wish to make and press <Enter>.

If you have chosen to enable multi-banks (see SECTION 7.1.2) you will next be asked:

POST TO BANK ACCOUNT [0000]

The bank account shown is the last 4 digits of the

bank account number of your default bank (as defined in General Ledger Maintenance (see SECTION 6 and SECTION 6.5.2).

This is the number on your chequebook, not the actual General Ledger account

number. HiFinance will find the General Ledger account for you. You can

initiate a search using <F9>.

The screen will now change and ask for the payment

lines. The period you are working in is displayed near the top-left-hand-corner

of the screen. Also, the total value of the payment (DB) you are creating is

displayed near the top-right-hand corner of the screen. This is a useful

reference when you are entering a dissected payment.

If you have enabled multi-banks, the actual General

Ledger account number of the bank you are posting to, will be displayed between

the PERIOD and BALANCE in the ribbon line of the

above screen.

There are several fields you will need to enter for

each line:

DATE This is the transaction date. It must be within the

accounting period you have defined, above. By default, HiFinance will offer

today’s date or the last date you used. You can use <F1> to specifically enter today’s date. The date may

only be entered once for each payment.

CHEQUE NUMBER This is the cheque number you are paying on. If this is

inappropriate, use 999999 as the cheque number. By default,

HiFinance will offer you one greater than the last number you entered. The

cheque number may only be entered once for each payment.

ACCOUNT This is the General Ledger account you wish to post

to. It may be any valid existing account, however, usually payments are posted

to expense or asset accounts. If you do not remember the account code, <F9> is available for searching the General Ledger

master-file. After choosing an account, HiFinance will also display the

Expected Sign and Current Value of the account, as a reference. This value is

read once and is not updated until you post your transactions. If you are

entering a dissected payment, <F1> is available to repeat the

account number. This can save time if you are entering a series of dissections that

post to the same account but with different descriptions and amounts.

DETAILS Here you enter the details of the payment. If you

are entering a dissected payment you may enter the details of each dissection

separately. This field must not be left blank. If you are entering a dissected

payment, <F1> is available to repeat the

description from the previous line. This can save time if you are entering a

series of dissections that have similar descriptions. Also, if you have used

this account before (and have updated the transaction) you may press <F9> to bring up the history of details you have used

before. There are up to 20 unique lines saved. Scroll down to the one you want

and press <F10> or <Enter>. The description will be automatically loaded and

you can the changed it if you wish. The new details line will be saved back to

the history file, when the transaction is updated.

TOTAL Here you enter the value of the line. The value can be

negative although this is not recommended. This is the total value of the line,

including any GST. You may leave this value zero and move to the next fields if

you are paying a bill that is formatted “plus GST” rather than “including GST”.

(See below.)

GST HiFinance will have an attempt to calculate this

based on the TOTAL field and the TAX RATE as specified in the General

Account. If you are amending the line, using the REVIEW

option, HiFinance will not compute the value unless you have changed the TOTAL. In this case you must calculate it yourself as any

attempt to guess the value will overwrite any previous manual computation.

EX-GST Here you enter the value of the transaction without GST. If you have entered a TOTAL, this will be calculated

automatically. When you leave this field, HiFinance will recompute the TOTAL as being the EX-GST field plus the GST field. In this way you can enter nothing for the TOTAL, enter a value for GST and EX-TAX and HiFinance will fill in the rest for you. If

upon exit from this field, the TOTAL is zero or not the same

sign as the rest of the transaction, an error will be generated and you will

have to amend the fields.

At each point you may press <ESC> to abort the line or the whole transaction.

If you have entered at least one line of a dissected

transaction, you may press <F5> (at the ACCOUNT field) to enter the REVIEW

function. This function allows you to view your entries, and if necessary

change or delete a line. To move between lines use <CsrUp>, <CsrDn>, <PageUp>, <PageDn>, <Home> and <End>. If there is a particularly

large number of lines, you can also use <F9> to go to a specific line

number. To modify a line, make sure it is displayed in full in the bottom

window and press <F3>. You can then re-enter any

of the details. To leave the REVIEW function, press <ESC> or <F10>, once.

To finally update your transaction, press <F10>. If you have enabled the printing of cheques, you

will then be asked to enter the payee name and address details. If you enter a

cheque number of 999999, no cheque will be printed.

This is a sundry number for such things as bank charges, etc.

Files updated by the General Ledger Payment program:

General

Ledger master-file: Each account balance

is updated in the chosen period with the value of each dissection. The bank is

updated with the total of transaction. If you have entered any GST component,

the appropriate GST account will also be updated.

General

Ledger transaction-file: A

transaction is posted for each transaction line for the total less GST and for

the GST value of the transaction.

Bank

Reconciliation file: An entry is

made into this file for the value of the payment.