HiFinance

4

SECTION

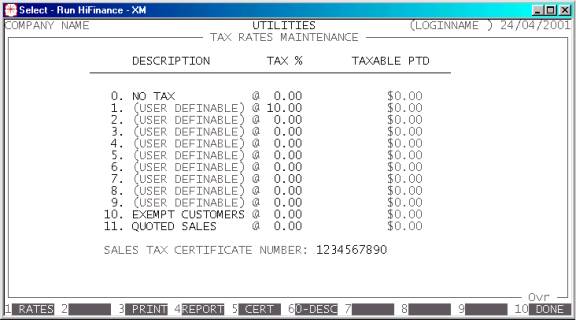

7.2.1.3 - TAX MAINTENANCE

USAGE: To setup and enquire on the sales-tax rates and

totals and to setup your company’s tax details.

DISCUSSION:

This function has several facilities:

a)

The

primary function is to setup the user-definable sales-tax rates. There are 12

tax rates available in HiFinance. These are used in INVOICING.

Rate zero is always zero

percent. This can be used for items that are sold at a zero rate of tax or

for items that are sold inclusive of tax. It is confusing to use the same rate

for both.

Rates 1 through 9 are

user-definable. This means that you have the ability to set them yourself to any

value from 0% to 99.99%.

Rates 10 and 11 are used for

customers who either can claim an exemption (eg schools) or have quoted a

sale-tax number, respectively.

To clear these totals, you must print the screen.

HiFinance will not offer you the option to clear until you do.

b)

The

screen displays the total accumulated sales within each tax rate. This is the

total taxable value. If you multiply this by the rate, you will have computed

the tax payable at that rate. The taxable rate may not equal the total sales if

you invoice at a tax-basis other than zero.

c)

The

screen also provides a space for you to enter your Sales-tax certificate

number. This will be printed on remittance advice’s printed for your Creditors.

This facility has been made redundant due to the GST but the provision is sill

in HiFinance for backward compatibility with old transactions.

d)

The screen appears as follows:

The function keys are as follows:

<F1> This allows you to change rates 1-9. There is no

requirement to enter the rates in any order and you may leave any or all of the

fields blank. You should be careful not to change a rate that has non-zero

sales. This will cause confusion when printing total payable tax. When you have

entered all the rates you require, press <F10> to update the files.

<F3> This initiates a report that lists the used rates

and the tax payable. After you print the report (to the screen or printer) you

will be offered the option to clear the totals. If you do, the totals will be

set back to zero. You should do this once a month to generate a report. This is

one method of calculating GST on Debtors. The other way is to view the

transactions in the General Ledger. The General Ledger also contains the

Creditor GST transactions.

<F4> This function is similar to the one above, except

that it actually reads through the Inventory transactions to generate the

totals. When you choose this function, HiFinance will ask you to choose a year

and period to report on. Having chosen the period, you can initiate the search.

The computer will scan the Inventory transactions and add up the tax charged in

that period. This is a more accurate method of calculating the tax because any

rounding in the calculations will reflect the actual calculation made at

the time the invoice was updated. It is also possible to backdate this function

to any period still on file. The disadvantage is that the report takes time to

scan the transaction-file and no updating can occur during this time. This

function does not include the option to clear the totals (cf <F3>).

<F5> This opens the

SALES TAX CERTIFICATE NUMBER field. The maximum length of this field is 10 characters.

<F6> Rate zero is always at a zero rate but you can change

the description. This is useful if you sell retail or inclusive of tax. In this

case, change the literal to INCL. or RETAIL or another relevant description.

<F10> or <ESC> This will

return you to the DEBTOR UTILITES MENU.

Any changes you have made will already be applied.