HiFinance

4

SECTION

2.3.4.1 - CREDITOR SINGLE PAYMENTS

USAGE: To apply debits to Creditors. This function

assumes you are entering single payments, eg single cheques, etc. The program

asks for the payment details and then the allocation details before applying

the transaction to the Creditor.

DISCUSSION: When you start the CREDITOR

PaYMENTS program, the computer will initially ask for a Creditor

code. Insert the code and press <Enter>.

To return to the CREDITOR DATA ENTRY MENU, press <ESC>.

To search for a Creditor, press <F9>. For further details on searches, see SECTION 1.2.

Having chosen a Creditor, you may be asked which

bank you wish to post to. This question will only appear if you have enabled

multi-banks. Enter the account number of the bank you wish to post to or press <F9> to initiate a search.

BANK ACCOUNT [0000]

If are running with a single bank, all bank postings

will automatically be made to the default bank.

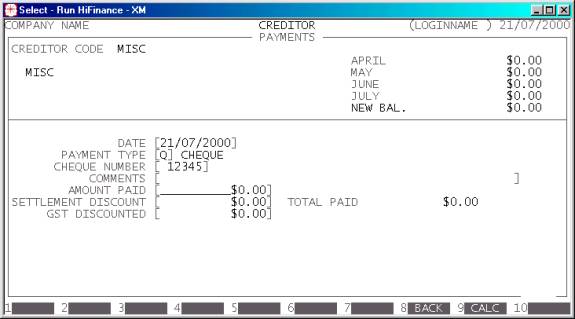

Next, the screen will display the name and address

and recent balances, in full at the top of the screen. The screen will appear

as follows:

The fields available are:

DATE This is date you wish to make the payment apply. The

date does not have to be in the current period, but if you backdate a

transaction, HiFinance will not let you choose a date in a closed period. To

close a period, use the CALENDAR

function. (See SECTION

7.1.6.). If you press <F1>, HiFinance will insert

today’s date into this field.

PAYMENT TYPE This is a letter from A to Z. It refers to the type of payment made, eg C = Cash, Q = Cheque, etc. The payment

types are defined in BANK TRANSACTION

TYPES, see SECTION

7.2.5.

REFERENCE NUMBER This can be any number from 1 to 999999. It is a reference for your internal auditing. It

is labelled REFERENCE NUMBER for cash type transactions.

The prompt changes to CHEQUE NUMBER if you are entering a

Cheque.

COMMENTS This is an optional field. You might wish to add some details

regarding this payment.

AMOUNT PAID This is the actual value of the payment maid. If you

are paying the whole amount outstanding, you may press <F1> to insert the value. Note that this value must be

positive. If you press <F9>, you will initiate HiFinance’s calculator. When you press <ESC> from the calculator, the result will be inserted

into the AMOUNT

PAID field.

SETTLEMENT DISCOUNT If you are allowed to take a discount, you may enter the value here.

This is also a convenient way of entering any small amount you do not intend to

pay, eg 10 cents out of an Invoice for $1000. This is simpler than separately

entering a write off amount through CREDITOR

ADJUSTMENTS. Like the AMOUNT PAID, this value must be

positive.

GST DISCOUNTED If you have entered a discount, there might be a GST

component. If so, HiFinance needs to know that value so that it can post

correctly to the General Ledger. The value you enter represents the portion of

the discount that is GST, so it cannot be greater than the value of the

discount. An example might be:- an outstanding balance of $105; you pay the

Creditor a cheque for $100 and take discount of $5, which includes 50¢ of GST.

The entries would be 100, 5 and 0.5 for amount, discount and GST, respectively.

TOTAL PAID This field is automatically inserted by HiFinance.

It is the sum of AMOUNT PAID and SETTLEMENT DISCOUNT.

<ESC> To abort the whole transaction, press <ESC>. You will then be returned to the Creditor code

entry routine.

You will next be asked, PAYMENT DETAILS OK? If they are, enter Y. The screen will change and ask for allocation information. A screen

will typically look as follows:

This is similar to the allocation screen in CREDITOR ALLOCATIONS. (see SECTION 2.3.5.) The

main difference is that if you do not allocate the whole amount of the Payment,

you will be required to enter a reason for the partial allocation. The result

of this is that HiFinance will force the Payment to be completely allocated.

Any portion left over is accounted for by an adjustment transaction that

carries its own description. A legitimate reason could be OVER PAYMENT.

Files updated by the Creditor Payments program:

Creditor

master-file: The Creditor’s balance will

be decreased by the TOTAL PAID.

Creditor

transaction-file: A receipt

transaction is created to match the total value of the TOTAL PAID. It also carries the value of any discount taken.

If the payment has not been fully allocated, an adjustment record is created

for the balance.

General

Ledger master-file: The Trade Creditors,

Cash-at-Bank and Discounts Taken accounts are updated. If there is a GST

component to the discount, the value is split between the Discount Taken and

GST receivable accounts.

General

Ledger transaction-file: A

transaction is posted for each transaction line.

Bank

master-file: The Bank master-file is

updated to reflect the fact that there has been a change of balance and that

there is a bank deposit slip pending.