HiFinance

4

SECTION

1.4.4.1 - DETOR INVOICE/COMMISSION REPORT

USAGE: To print a list of Debtor Invoices (and Credit

Notes) detailing the values, profitability and commission payable. The

commission is based on sales less tax and freight. This report can also be used

as an Invoice Journal.

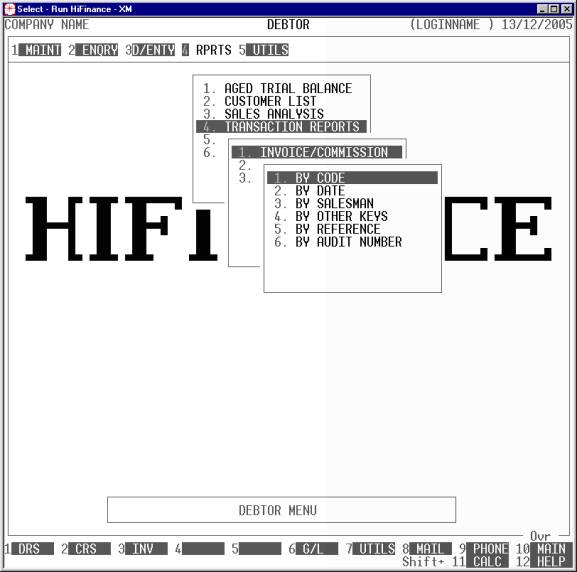

DISCUSSION: When you choose this option, the screen will

appear as follows:

Here you can choose the order in which you wish to

print the report. Choose the order you wish to print the report in by pressing the

number next to the option. If you choose to print BY OTHER KEYS, another menu will open to allow you to specify

which of the three OTHER KEYS you actually require.

Hint: If you intend to limit the report to a range of

transactions, it is most efficient to print the report in the same order. Eg if

you wish to limit the report to a range of salesmen, the report will scan the

transaction-file faster if you also print the report in salesman order.

Having chosen from the options, the following

questions will appear:

USE LONG FORMAT REPORT If you are using wide stationery, reply Y, otherwise reply N. This question will only be

displayed if the relevant option is set to A, see SECTION 7.1.2.

START A NEW PAGE ON

CHANGE OF KEY If you have chosen to print

the report in Debtor, date or Salesman order, you will be offered this option.

If you reply Y, HiFinance will start a new

page each time the major key changes. A sub-total will also be printed for each

group of transactions. If you reply N, the transactions will be

printed continuously.

INCLUDE INVOICE LINE

DETAILS If you enter N here,

the report will print one line per Invoice. If you enter Y, the report will also detail the Inventory transactions for each

Invoice. The latter option is longer because it prints much more detail.

SUPPRESS COS AND MARGIN

INFORMATION There are times when you might wish to

print this report without showing any profit information. If you enter Y here, the report will not print cost-of-sales or margin information.

INCLUDE ALL DEBTOR

TRANSACTIONS If you do not wish to set any limits on

the report, enter Y otherwise enter N. If you enter N, you will be asked a list

of further questions.

The following question asks you to enter both a lower

and upper limit. The upper limit must not be less than the lower limit. The

default answers define the extreme limits of the field. You do not have to

change all of these limits. Only change the ones you wish to, and tab past the

others.

DEBTOR CODE RANGE This is the Bill-to Debtor’s code.

SALESMAN RANGE This is the salesman code as it appears on the transaction-file (not

the Debtor master-file).

OTHER KEY RANGES These may appear as a different literal depending on how you

have defined the fields in SYSTEM

PARAMETERS.

GROUP RANGE This is the Debtor Group.

TRANSACTION DATE RANGE This is the Invoice date.

TRANSACTION VALUE RANGE This is the total value of the Invoice.

REFERENCE RANGE This Invoice number or Credit Note number.

AUDIT NUMBER RANGE This Transaction Audit Number. Printing in this order will sort

the report in the order the transactions were entered into the system

irrespective of whether a transaction was forward or backdated.

In all cases, the default answers are the extreme

limits of each range. So if you do not wish to limit the report on a particular

field, just bypass it.

To start the report, press <Enter> through each field or simply press <F10>.

The report will scan the transaction file and

extract all records that fit within your chosen parameters. The report itself

will detail the Transaction Date, Invoice number, Other Key, Salesman code,

Actual Debtor code, Transaction Type, Invoice value, Sales-tax, Freight, Gross

Margin and any commission payable as a dollar amount. The Long Format option

also details the Actual Debtor’s name and the Cost-of-Sales. At the end of the

report, the monetary columns are totalled.

Gross Margin is defined as :

(Net Sales - Cost-of-Sales)

/ Net Sales * 100%

where: Net Sales = Invoice-total - Freight -

Sales-tax.